Introduction

Peer-to-peer (P2P) lending has emerged as a disruptive force in the financial industry, transforming the way individuals and businesses access financing. By connecting borrowers directly with lenders through online platforms, P2P lending bypasses traditional intermediaries, such as banks, offering a range of benefits for both borrowers and lenders. In this article, we will explore P2P lending in greater depth, examining its mechanics, advantages, risks, and its potential to reshape the financial landscape.

Mechanics of P2P Lending

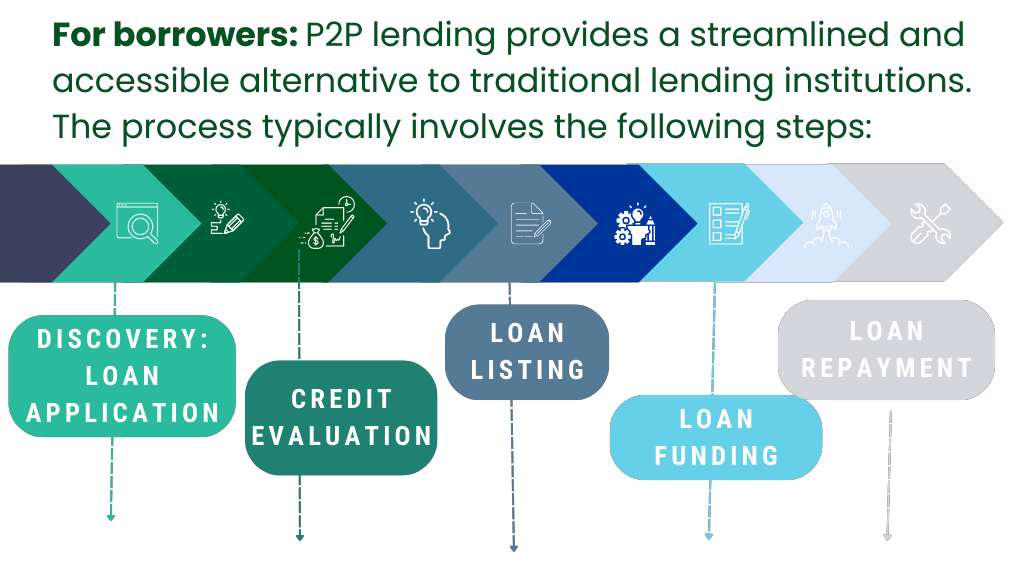

Borrower’s Perspective

For borrowers, P2P lending provides a streamlined and accessible alternative to traditional lending institutions. The process typically involves the following steps:

- Loan Application: Borrowers create loan listings on P2P lending platforms, providing details such as loan amount, purpose, and interest rate preferences.

- Credit Evaluation: P2P lending platforms employ sophisticated algorithms to assess the creditworthiness of borrowers. This evaluation includes factors such as credit scores, income verification, and financial history.

- Loan Listing: Once approved, the borrower’s loan listing is made available for potential lenders to review and fund.

- Loan Funding: Lenders review loan listings and choose those that align with their investment criteria. Multiple lenders may contribute to funding a single loan, spreading the risk.

- Loan Repayment: Borrowers make regular loan repayments, including principal and interest, to the P2P lending platform. The platform then distributes the repayments to the respective lenders.

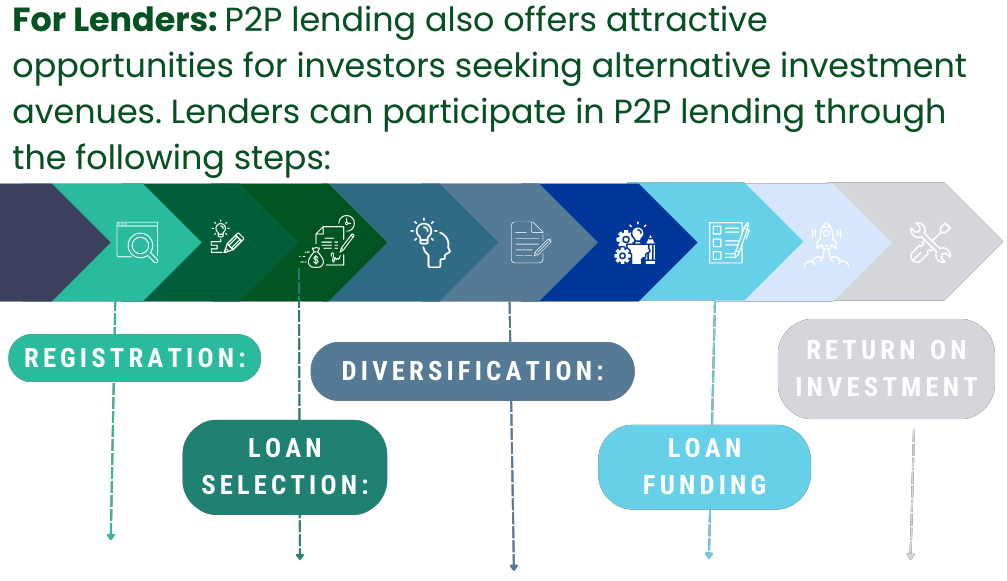

The Lender’s Perspective

P2P lending also offers attractive opportunities for investors seeking alternative investment avenues. Lenders can participate in P2P lending through the following steps:

- Registration: Lenders sign up on P2P lending platforms and create investor profiles, specifying their investment preferences and risk tolerance.

- Loan Selection: Lenders review available loan listings on the platform, considering factors such as borrower profiles, loan purpose, and interest rates offered.

- Diversification: To mitigate risk, lenders can diversify their investments across multiple loans, allocating funds to different borrowers and loan types.

- Loan Funding: Lenders contribute funds towards loans they select, which collectively form the total loan amount requested by the borrower.

- Return on Investment: Lenders receive periodic loan repayments from borrowers, including principal and interest. These repayments generate returns on their investments.

Advantages of P2P Lending

Access to Financing

P2P lending provides an alternative source of financing for borrowers who may face challenges in securing loans from traditional financial institutions. Individuals with limited credit history, small businesses, or those seeking funds for specialized purposes can find P2P lending platforms more open to lending to a diverse range of borrowers.

Competitive Interest Rates

Due to the lower operational costs associated with P2P lending platforms, borrowers can often obtain loans at more competitive interest rates compared to traditional lenders. This affordability can make P2P lending an attractive option for borrowers looking to save on interest expenses.

Ease and Convenience

P2P lending platforms offer a convenient online interface, simplifying the loan application and approval process. Borrowers can create loan listings, upload required documents, and receive loan funds electronically, reducing the time and effort typically associated with traditional loan applications.

Investment Opportunities

For lenders, P2P lending presents an opportunity to diversify their investment portfolios beyond traditional assets. By allocating funds across multiple loans, lenders can spread their risk and potentially earn attractive returns through interest income.

Transparency and Control

P2P lending platforms provide borrowers and lenders with transparent access to information regarding loans, interest rates, and borrower profiles. This transparency empowers participants to make informed decisions, fostering trust and accountability within the lending ecosystem.

Risks and Challenges of P2P Lending

Default Risk

One of the primary risks in P2P lending is the potential for borrower defaults. Despite diligent credit assessments, some borrowers may fail to repay their loans as agreed, leading to potential financial losses for lenders. Mitigating this risk often involves diversifying investments across multiple loans and carefully evaluating borrower creditworthiness.

Platform Risk

The reliability and credibility of P2P lending platforms can vary. Choosing reputable platforms with a proven track record is essential to mitigate the risk of platform failures, fraudulent activities, or inadequate borrower screening processes. Thorough due diligence and research are crucial for both borrowers and lenders when selecting a platform.

Regulatory Environment

P2P lending operates within a regulatory framework that may differ across jurisdictions. Regulations aim to protect the interests of both borrowers and lenders, ensuring fair practices, transparency, and stability within the P2P lending industry. Compliance with applicable regulations is essential for the long-term sustainability and success of P2P lending platforms.

The Future of P2P Lending

P2P lending has already made a significant impact on the financial industry, and its influence is expected to continue growing. As technology advances, P2P lending platforms are likely to become more sophisticated, incorporating artificial intelligence, machine learning, and blockchain technology. These advancements will further streamline processes, enhance risk assessment, and improve the overall user experience for borrowers and lenders.

Furthermore, the ongoing democratization of finance through P2P lending can drive financial inclusivity, providing access to capital for underserved individuals and communities. By connecting borrowers directly with lenders, P2P lending has the potential to reshape the traditional banking landscape and foster a more accessible and inclusive financial ecosystem.

FAQs (Frequently Asked Questions)

- Q: What interest rates can I expect as a lender?

- A: Interest rates vary depending on the borrower’s creditworthiness and the platform you choose. They can range from 6% to 20%.

- Q: How do P2P lending platforms assess borrower creditworthiness?

- A: P2P lending platforms use various methods, including credit checks, income verification, and risk assessment algorithms, to evaluate borrower creditworthiness.

- Q: Can I invest in P2P lending with a small amount of money?

- A: Yes, many P2P lending platforms allow you to start with a minimum investment amount, typically around $500.

- Q: Are my investments in P2P lending protected?

- A: P2P lending investments are not typically covered by deposit insurance. It’s important to diversify your investments and choose reputable platforms to minimize risk.

Additional References

Borrowell: A Canadian P2P lending platform that offers personal loans and free credit score monitoring to borrowers.

Lending Loop: Canada’s first regulated P2P lending platform that connects small businesses with investors for financing opportunities.

National Crowdfunding & Fintech Association (NCFA Canada): An organization in Canada that advocates for and supports the growth of P2P lending and crowdfunding in the country.

- BNPL Landscape: An informative article discussing the Buy Now Pay Later (BNPL) landscape, which provides insights into the evolving financial landscape and alternative financing options.

- BNPL in Various Sectors: An article that explores the application of Buy Now Pay Later (BNPL) services in different sectors, providing valuable information on the expanding role of alternative financing in various industries.