Introduction

In this blog post, we will explore the world of peer-to-peer (P2P) lending and how it can benefit Canadians like you. We will provide you with valuable information about P2P lending, its benefits, risks, and tips for successful investing. By the end of this article, you will have the knowledge and confidence to make the best decision for yourself when it comes to P2P lending.

What is Peer-to-Peer lending?

P2P lending, also known as peer-to-peer lending or social lending, is a form of borrowing and lending that takes place directly between individuals, bypassing traditional financial institutions such as banks. It operates on online platforms that connect borrowers and lenders, enabling them to interact and negotiate loan terms.

How does Peer-to-Peer lending work?

Peer-to-peer lending, a form of alternative financing, operates through a platform where borrowers and lenders directly interact, eliminating the need for traditional financial institutions. This innovative lending model empowers individuals and businesses seeking loans while providing investors with opportunities to grow their capital.

The process begins when borrowers create loan listings on the P2P platform, offering crucial details such as the desired loan amount, purpose, and the interest rate they are prepared to pay. These listings are meticulously examined by potential lenders, who thoroughly evaluate each borrower’s profile and financial information before deciding to invest in a particular loan.

Once lenders identify a loan that aligns with their investment goals and risk appetite, they provide the necessary funds to fulfill the borrower’s loan request. As a result, borrowers gain access to the required capital to finance their projects or meet their financial obligations. Subsequently, borrowers commit to repaying the loan on a regular basis according to the agreed-upon terms.

The repayment funds received from borrowers are then distributed proportionally among the lenders who contributed to the loan. The P2P platform acts as an intermediary, facilitating the seamless transfer of payments between borrowers and lenders, while also ensuring the privacy and security of all parties involved.

Overall, P2P lending offers a decentralized and efficient alternative to traditional lending systems, providing borrowers with access to capital and enabling lenders to diversify their investment portfolios. With its transparent and technology-driven approach, peer-to-peer lending continues to reshape the financial landscape, fostering greater financial inclusion and generating mutually beneficial outcomes for borrowers and investors alike.

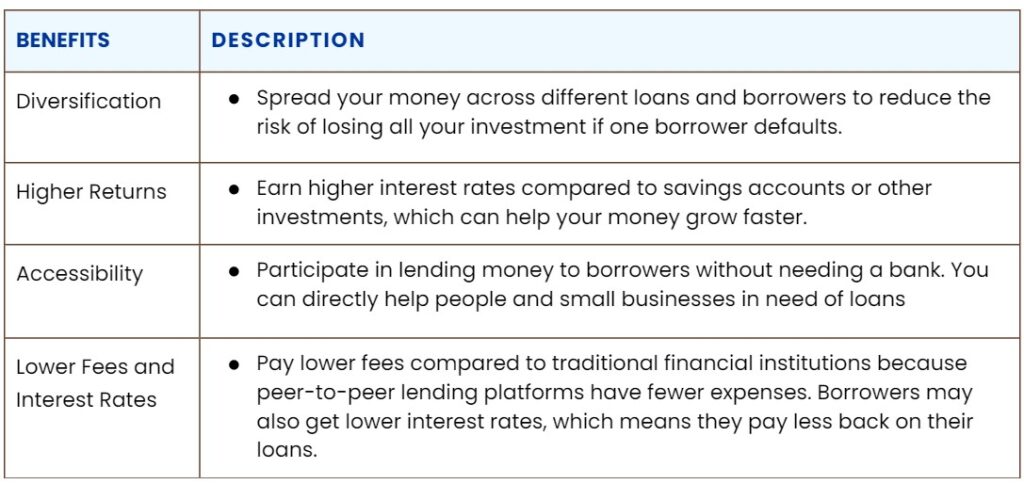

Benefits of Peer-to-Peer Lending

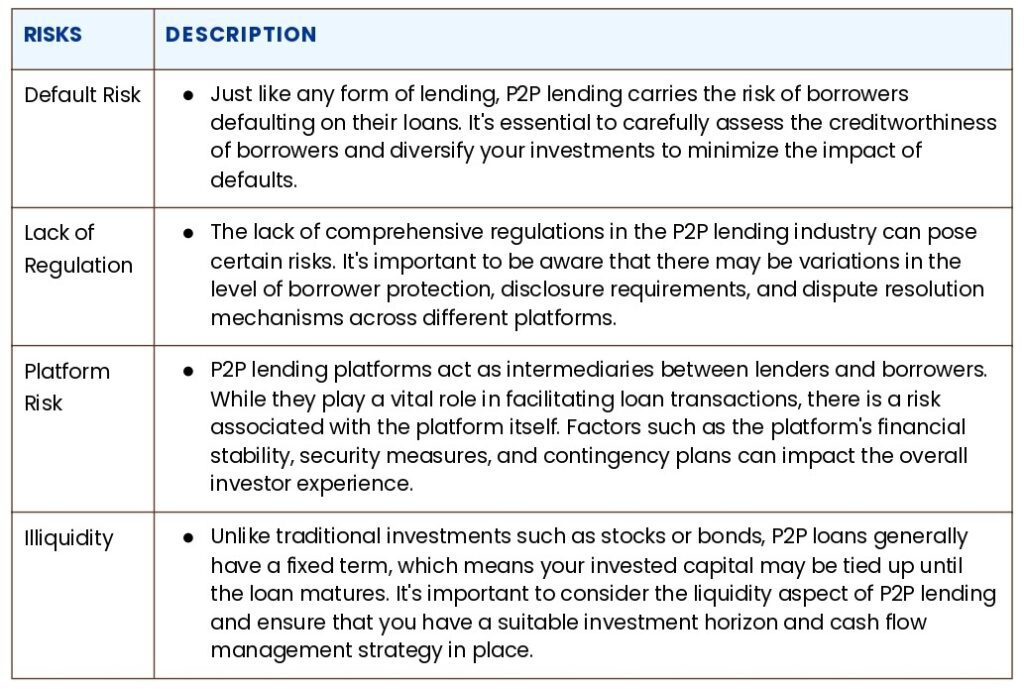

Risks of Peer-to-Peer Lending

Choosing the Right Peer-to-Peer Platform

When venturing into P2P lending, it’s crucial to choose the right platform that aligns with your investment goals and risk tolerance. Here are some factors to consider when selecting a P2P platform:

Reputation and Track Record

Look for platforms that have a strong reputation in the industry and a track record of successful loan originations and repayments. Research the platform’s history, customer reviews, and ratings to gain insights into its credibility and reliability.

Transparency and Disclosure

A reputable P2P lending platform should provide transparent information about borrowers, loan terms, interest rates, and associated fees. Pay attention to platforms that offer comprehensive disclosure and ensure that you have a clear understanding of the risks involved.

Loan Types and Risk Rating

Consider the variety of loan types available on the platform and assess their risk ratings. Diversification is key to managing risk effectively, so choose a platform that offers a range of loan categories and risk profiles.

Secondary Market

Evaluate whether the platform has a secondary market where you can sell your loan investments before they reach maturity. This feature provides additional flexibility and liquidity options for investors.

Fees and Charges

Review the fee structure of the platform, including any origination fees, servicing fees, or penalties. Compare these costs across different platforms to ensure you are getting a competitive deal.

Tips for Successful Peer-to-Peer Investing

Now that you have a better understanding of P2P lending, here are some tips to help you navigate the investment process and make informed decisions:

Start Small and Diversify

When getting started with P2P lending, it’s advisable to begin with a small investment amount. This allows you to test the waters and familiarize yourself with the platform’s operations. As you gain experience and confidence, gradually increase your investments and diversify across multiple loans to reduce risk.

Do Thorough Research

Before committing your funds to any P2P lending platform, conduct thorough research. Analyze the platform’s loan origination process, underwriting standards, borrower profiles, and historical loan performance. This information will help you make informed decisions and choose the loans that align with your risk appetite.

Understand the Risks

P2P lending carries inherent risks, and it’s essential to fully understand them before investing. Familiarize yourself with the risks of default, platform risk, and illiquidity. Assess the risk mitigation measures implemented by the platform and consider the potential impact on your investment portfolio.

Monitor Your Investments

Once you start investing in P2P loans, regularly monitor the performance of your investments. Stay updated on borrower repayment schedules, loan status, and

monitor your investments, and stay informed about any changes in the borrower’s financial situation. By actively monitoring your investments, you can identify any red flags or signs of potential default early on and take appropriate action.

List of Peer-to-Peer Lending Opportunities in Canada

To help you get started, we’ve curated a list of trusted P2P lending platforms in Canada:

- Lending Loop – Connects small businesses with investors. Visit Lending Loop to learn more.

- FundThrough – Offers invoice financing for Canadian businesses. Access quick working capital at FundThrough.

- Peerage Capital – P2P platform for real estate investments across Canada. Explore opportunities at Peerage Capital.

- FrontFundr – Crowdfunding platform offering investments in startups and growth-stage companies. Discover more at FrontFundr.

When considering P2P lending, always conduct thorough research and due diligence. Understand each platform’s offerings, risk profiles, and terms to make informed investment decisions. Keep in mind that this list is not exhaustive, and new platforms may emerge. Embrace the opportunities of P2P lending in Canada while empowering local businesses and projects.

Please note that investing in P2P lending carries risks, and it’s advisable to consult with a qualified financial professional before making any investment decisions.

Conclusion

In conclusion, Peer-to-Peer lending offers an alternative investment option for Canadians looking to diversify their portfolios and potentially earn higher returns. While it presents opportunities, it’s crucial to be aware of the associated risks and make informed decisions. By choosing reputable platforms, conducting thorough research, diversifying your investments, and actively monitoring your portfolio, you can navigate the Peer-to-Peer lending landscape with confidence.

Now that you have a better understanding of P2P lending in Canada, take the next step towards empowering yourself financially. Assess your risk tolerance, set clear investment goals, and explore the reputable P2P lending platforms available to Canadians. Remember to always prioritize transparency, due diligence, and ongoing evaluation to make the best decisions for your financial future.

FAQs

1. Is P2P lending safe in Canada?

P2P lending in Canada carries risks, just like any investment. It’s essential to choose reputable platforms, diversify your investments, and conduct thorough research before investing.

2. What returns can I expect from P2P lending?

P2P lending can offer attractive returns compared to traditional investment options. However, the exact returns vary depending on factors such as the loan type, borrower creditworthiness, and prevailing market conditions.

3. Are my investments in P2P loans insured?

P2P loans are generally not insured by the Canadian Deposit Insurance Corporation (CDIC) or any other government-backed insurance program. It’s important to understand and assess the risks involved before investing.

4. Can I withdraw my funds from P2P loans before maturity?

P2P loans are typically illiquid investments, meaning your funds are tied up until the loan term matures. However, some platforms may offer a secondary market where you can sell your investments to other investors.

5. How can I assess the creditworthiness of borrowers on P2P lending platforms?

P2P lending platforms provide information about borrowers’ credit profiles, income, and loan purpose. Additionally, platforms may assign risk ratings to loans. It’s essential to review this information and consider the platform’s underwriting standards to make informed investment decisions.

Additional Resources

- P2P Banking – A website that provides news, insights, and information on P2P lending globally. Visit P2P Banking to stay updated on the latest developments in the industry.

- Better Business Bureau (BBB) – The BBB provides ratings, reviews, and accreditation information for businesses operating in Canada. Before engaging with a P2P lending platform, check its BBB profile (BBB Canada) to assess its reputation and customer satisfaction.

- Wealth Solutions Hub – An informative resource that offers insights on finance and fintech for beginners. Check out our article at Wealth Solutions Hub.