Introduction

Welcome to our comprehensive review of Lending Loop, Canada’s premier peer-to-peer lending platform. In this in-depth analysis, we will explore Lending Loop’s unique features, benefits, and success stories, providing you with the information you need to make an informed decision about your business financing. Join us as we delve into the world of Lending Loop and discover how it can unlock the full potential of your business.

Are you a small or medium-sized business struggling to secure a loan from traditional banks due to irregular revenue or the perceived insignificance of your funding needs? Look no further than Lending Loop, Canada’s first and only regulated peer-to-peer (P2P) lending platform. Lending Loop provides a unique platform that allows individual investors to lend money directly to local businesses, bypassing the challenges posed by traditional lending institutions. Although Lending Loop is accessible to everyone in Canada except Quebec, its impact has been substantial since its inception in late 2015, with 7,282 investors participating and over $27 million in loans funded as of September 2018.

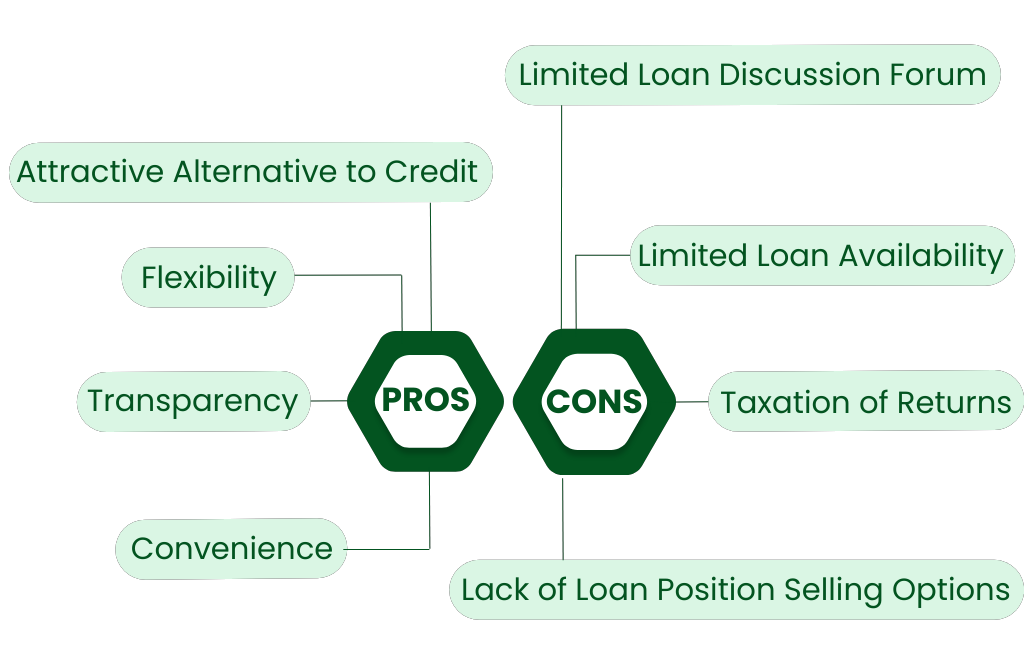

Pros of Lending Loop:

- Diversification: Lending Loop allows investors to diversify their investments beyond traditional markets, such as stocks and real estate, by directly supporting local businesses.

- Higher Returns: Compared to other investment vehicles, Lending Loop has the potential to generate higher returns, providing an opportunity for increased profitability.

- Low Minimum Investment: With a minimum investment requirement of just $25 per loan, Lending Loop enables investors to achieve greater diversification with smaller amounts of capital.

- User-Friendly Platform: Lending Loop offers a user-friendly platform that provides easy access to portfolio information, payment schedules, and other relevant details, making it convenient for investors to track their investments.

- Collections Management: In the event of loan delinquency, Lending Loop manages the collections process, reducing the administrative burden on lenders and streamlining the overall experience.

Cons of Lending Loop:

- Taxation of Returns: Lending Loop does not offer Tax-Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) account options, which means returns from investments are subject to taxation, requiring investors to account for investment income on their taxes.

- Limited Loan Discussion Forum: Lending Loop lacks a dedicated forum for loan discussions, limiting the opportunity for investors to engage in detailed conversations and share insights with other investors.

- Limited Loan Availability: At times, the availability of loans on the platform can be limited, resulting in funds sitting idle for extended periods before being invested. This can impact liquidity and the overall investment experience.

- Lack of Loan Position Selling Option: There is currently no option to sell your loan position on Lending Loop, meaning that once invested, your funds are tied up for the duration of the loan term.

Investing Strategies and Risk Considerations:

- Risk-Based Approach: Consider your risk tolerance and align your investments accordingly. A and B loans are generally considered less risky, while C, D, and E loans carry higher levels of risk.

- Diversification: Diversify your portfolio by investing in a mix of loans across different risk categories. This helps spread the risk and potentially improves overall returns.

- Loan Amount: Allocate smaller amounts to each investment to minimize exposure to potential charge-offs. Determine an investment amount that balances risk and reward according to your comfort level.

- Loan Term: Consider the liquidity requirement of your investments. Shorter-term loans offer more frequent principal repayments, providing greater liquidity compared to longer-term loans.

- Automation Options: Lending Loop’s auto-lend feature is ideal for hands-off investors, automatically investing funds based on a chosen risk profile. Additionally, the auto-deposit feature allows for regular deposits from a linked bank account.

Note: These strategies are suggestions and should be evaluated based on individual preferences and goals.

What is Peer-to-peer (P2P) lending?

Peer-to-peer (P2P) lending is a form of lending that connects individuals or businesses in need of funds with investors willing to lend money. This innovative lending model bypasses traditional financial institutions, allowing borrowers to access financing directly from a pool of investors. Here are the key points to understand about P2P lending:

- Direct Connection: P2P lending platforms serve as intermediaries, connecting borrowers and investors directly, eliminating the need for a traditional banking institution.

- Borrower’s Perspective: Borrowers benefit from easier access to loans, especially those who may face challenges obtaining financing through traditional channels due to factors like credit history or the size of the loan.

- Investor’s Perspective: Investors have the opportunity to earn attractive returns by lending money to individuals or businesses, effectively becoming lenders themselves.

- Diverse Loan Options: P2P lending platforms offer a variety of loan options, including personal loans, small business loans, and student loans, catering to different borrowing needs.

- Risk and Return: P2P lending involves assessing the creditworthiness of borrowers. Higher-risk borrowers typically pay higher interest rates, offering potential investors the opportunity for higher returns, but with associated risks.

- Technology-Driven: P2P lending platforms leverage technology, allowing for seamless loan origination, efficient loan processing, and effective risk assessment.

- Transparency and Efficiency: P2P lending platforms provide transparency by disclosing relevant information about borrowers and loan terms. This transparency, combined with efficient loan processing, benefits both borrowers and investors.

- Regulation and Protection: P2P lending platforms are subject to regulatory oversight in many jurisdictions, ensuring fair practices, consumer protection, and risk mitigation.

Overall, P2P lending has emerged as an alternative financing option that offers benefits to both borrowers and investors, disrupting the traditional lending landscape by facilitating direct lending relationships between individuals and businesses.

Additional Resources

- BNPL Landscape: An informative article discussing the Buy Now Pay Later (BNPL) landscape, which provides insights into the evolving financial landscape and alternative financing options.

- BNPL in Various Sectors: An article that explores the application of Buy Now Pay Later (BNPL) services in different sectors, providing valuable information on the expanding role of alternative financing in various industries.

- P2P Lending Canada: An article that provides valuable information about P2P lending, its benefits, risks, and tips for successful investing in Canada.