Home insurance is a vital aspect of protecting your property and belongings. It provides financial security in the event of unforeseen circumstances such as natural disasters, theft, or accidents. However, insurance premiums can be costly, especially for homeowners in Canada. In this blog post, we will explore some effective strategies to help Canadians save money on their home insurance. By following these tips, you can ensure adequate coverage while keeping your insurance costs under control.

1. Shop Around for Quotes

When looking to save money on home insurance, it’s important to compare quotes from different insurance providers. Here are key things to consider:

- Insurance Brokers: Consider working with insurance brokers who specialize in home insurance. They have access to multiple insurance providers and can assist you in finding the best options.

- Reputation and Stability: Look for insurance providers that have a strong reputation and stability in the market. This ensures reliability and trustworthiness.

- Coverage: Pay attention to the coverage limits offered by each insurance provider. Ensure that the policy adequately protects your home and belongings.

- Deductibles: Consider the deductible amount you would need to pay out of pocket before insurance coverage applies. A higher deductible can lower your premiums, but be sure it’s an amount you can afford in case of a claim.

- Additional Features: Look for any additional features or benefits offered by the insurance provider, such as identity theft coverage or emergency assistance.

- Insurance Premiums: Compare the premium costs quoted by different insurers. Remember that the cheapest option may not always provide the necessary coverage.

Here are some insurance brokers in Canada that you can consider for obtaining quotes:

2. Bundle Your Policies

Bundling your insurance policies is an effective strategy for saving money on home insurance. It involves combining your home insurance policy with other insurance policies you may have, such as auto insurance, under a single insurance provider. Here’s what you need to know:

- What is bundling?

- Bundling refers to the process of purchasing multiple insurance policies from the same insurance company. Instead of having separate policies from different insurers, you consolidate them with one provider. In the context of home insurance, it means getting both your home insurance and another type of insurance, such as auto insurance, from the same company.

- What are the benefits of bundling?

- Bundling offers several benefits, including:

- Discounts: Many insurance companies provide discounts when you bundle your policies. These discounts can significantly reduce your overall premium costs. By combining your policies, you become a multi-policyholder, which makes you eligible for potential savings.

- Convenience: Bundling simplifies your insurance management. Instead of dealing with multiple insurers and policies, you have a single point of contact for all your insurance needs. This can streamline the process of making changes, filing claims, and managing your coverage.

- Consistent Coverage: Bundling policies with the same insurer ensures consistency in coverage terms and conditions. This can be beneficial in terms of policy language, deductibles, and claims processes. It helps avoid any potential gaps or overlaps in coverage that may arise when dealing with different insurers.

- Bundling offers several benefits, including:

- How does bundling save you money?

- Insurance companies encourage policy bundling by offering discounts. By consolidating your policies with a single insurer, you become a valuable customer for them. Insurers appreciate customer loyalty and are willing to reward it with cost savings. Bundling your policies allows the insurance company to retain more of your business, leading to lower premiums on all the policies you bundle.

- What types of policies can you bundle with home insurance?

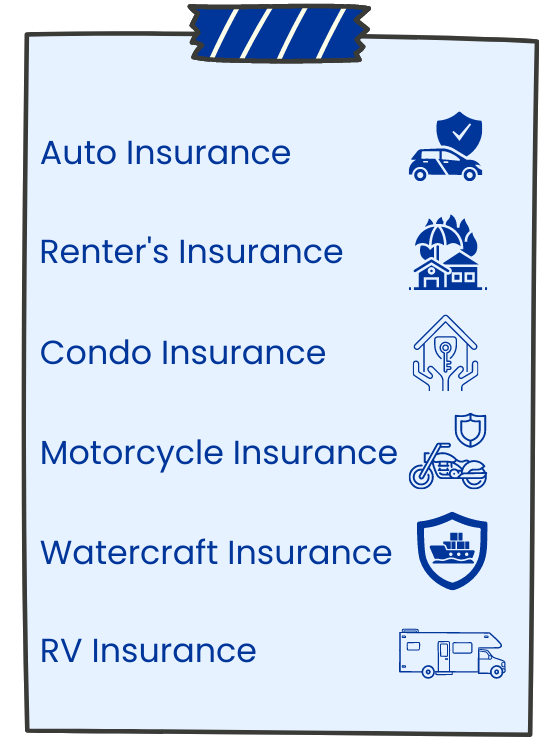

- While the focus here is on home insurance, you can bundle it with various other types of insurance policies, including:

By bundling your policies, you can enjoy the benefits of discounts, convenience, and consistent coverage. It’s advisable to compare bundled insurance quotes from different providers to ensure you are getting the best value for your money. Remember, bundling policies is a strategy that can save you money while simplifying your insurance management.

3. Increase Your Deductible

One effective strategy for reducing your home insurance premiums is to increase your deductible. Understanding what a deductible is and how it affects your insurance costs is important. Here’s a detailed explanation:

- What is a deductible?

- A deductible is the amount of money you are responsible for paying out of pocket when you file an insurance claim before your insurance coverage kicks in. It represents the portion of the claim that you agree to absorb. For example, if you have a $1,000 deductible and file a claim for $5,000 in damages, you would pay the first $1,000, and the insurance company would cover the remaining $4,000.

- How does increasing your deductible lower premiums?

- When you choose a higher deductible, you agree to take on a larger portion of the financial responsibility in the event of a claim. By doing so, you demonstrate to the insurance company that you are willing to absorb more of the risk. In return, the insurance company typically rewards you by offering lower premium rates. The reasoning behind this is that by having a higher deductible, you become less likely to file small or frequent claims, which can be more costly for the insurance company to process.

- Considerations when increasing your deductible:

- Affordability: It’s crucial to choose a deductible amount that you can comfortably afford to pay out of pocket in case of a claim. Analyze your finances and ensure that you have sufficient funds set aside to cover the deductible if needed.

- Risk tolerance: Increasing your deductible means taking on greater financial risk. Consider your personal risk tolerance and evaluate how comfortable you are with assuming a higher level of responsibility for potential claims.

- Savings potential: Evaluate the potential savings on your home insurance premiums compared to the increased financial responsibility of a higher deductible. Calculate how much you could save annually by choosing a higher deductible and assess if the savings outweigh the increased out-of-pocket cost in case of a claim.

- Impact on claims: Keep in mind that a higher deductible means you would be responsible for a larger portion of the cost in the event of a claim. Assess the likelihood of filing a claim based on your circumstances, the age and condition of your home, and the potential risks you may face. If you live in an area prone to natural disasters or have valuable assets to protect, it’s important to weigh the potential savings against the risk of a larger financial burden.

By carefully considering these factors, you can determine whether increasing your deductible is a viable option for you. It can lead to substantial savings on your home insurance premiums while potentially requiring a higher financial contribution if you file a claim.

Remember, it’s crucial to select a deductible that strikes the right balance between affordability and potential savings. Discuss your options with your insurance provider or broker to understand how different deductible amounts will affect your premiums and overall coverage.

4. Install Safety Measures

Installing safety features in your home is an effective way to mitigate risks, enhance security, and potentially lower your home insurance premiums. By taking proactive steps to protect your home, you demonstrate to insurers that you are actively working to minimize potential risks. Here are some important safety measures to consider:

- Smoke Detectors:

- Install smoke detectors on every level of your home, including inside bedrooms and near the kitchen.

- Regularly test and maintain the smoke detectors by replacing batteries as needed and cleaning them to ensure proper functionality.

- Smoke detectors can quickly detect and alert you to the presence of smoke, helping you and your family evacuate in case of a fire. This reduces the risk of significant property damage and potential loss of life, thus making your home a safer place.

- Burglar Alarms:

- Install a burglar alarm system or security system in your home.

- Choose a system that suits your needs, such as one that includes sensors on windows and doors, motion detectors, and a loud alarm or a system that alerts authorities in case of a break-in.

- Burglar alarms act as a deterrent to potential intruders, reducing the risk of theft or vandalism. They provide an added layer of protection and increase the safety of your home.

- Deadbolt Locks:

- Install deadbolt locks on all exterior doors of your home.

- Choose high-quality deadbolt locks that are resistant to picking or tampering.

- Deadbolt locks provide enhanced security by making it more difficult for unauthorized individuals to force their way into your home. This reduces the risk of break-ins and potential property loss.

- Additional Safety Measures:

- Consider other safety measures, such as installing window security film, reinforcing doors and windows, or adding security cameras.

- Window security film can make it more difficult for burglars to break through glass windows, reducing the risk of forced entry.

- Reinforcing doors and windows with additional hardware, such as stronger frames or impact-resistant glass, can enhance the structural integrity of your home and deter intruders.

- Security cameras provide surveillance and evidence in the event of a security breach, helping to identify potential culprits.

By implementing these safety measures, you not only enhance the security of your home but also demonstrate to insurance providers that you are actively reducing the likelihood of accidents, burglaries, or damages. This proactive approach can result in lower home insurance premiums. However, it’s important to consult with your insurance provider to understand the specific safety features that may qualify for discounts or premium reductions.

Remember, investing in safety measures is a valuable long-term investment that not only helps protect your property but also promotes peace of mind for you and your loved ones.

5. Maintain a Good Credit Score

Your credit score plays a surprising role in determining your home insurance premiums. Insurance companies in Canada often take credit scores into account when setting insurance rates. Here’s what you need to know:

- What is a credit score?

- A credit score is a numerical representation of your creditworthiness, which reflects your financial history and how responsible you have been in managing credit. It takes into account factors such as your payment history, credit utilization, length of credit history, types of credit used, and recent credit applications. Lenders, including insurance companies, use this score to assess the level of risk you represent when it comes to extending credit or offering insurance coverage.

- How does your credit score affect your home insurance premiums?

- Insurance companies view credit scores as an indicator of risk. Maintaining a good credit score demonstrates financial responsibility and suggests that you are more likely to make timely premium payments. As a result, insurers may consider you a lower-risk policyholder and offer more affordable premiums.

For more information about credit scores visit our blog “Credit Score Guide: Understanding and Improving Your Credit Score in Canada“.

6. Review Your Coverage Regularly

Regularly reviewing your home insurance coverage is crucial to ensure that you have the right level of protection based on your changing circumstances. By evaluating your coverage periodically, you can avoid overpaying for unnecessary protection or being underinsured when you need to make a claim. Here’s what you need to know:

1. Why is it important to review your coverage?

- Changing Circumstances: Life is dynamic, and your circumstances can change over time. Whether you renovate your home, purchase new valuable possessions, or experience changes in your family situation, it’s essential to reassess your coverage to make sure it aligns with your current needs.

- Avoid Overpaying: If you have coverage that exceeds what is necessary, you may be paying higher premiums than required. By reviewing your policy, you can identify areas where you can adjust your coverage to save money without compromising essential protection.

- Prevent Underinsurance: On the other hand, if you don’t have adequate coverage, you may find yourself underinsured when it comes time to file a claim. Regularly reviewing your coverage allows you to address any gaps and ensure you have sufficient protection in case of unforeseen events.

2. How often should you review your coverage?

- Annual Basis: It’s generally recommended to review your home insurance coverage on an annual basis. This provides a good opportunity to assess any changes that have occurred during the past year and make adjustments accordingly.

- Major Life Events: Additionally, major life events such as purchasing a new home, renovating, getting married, having children, or significant changes in your financial situation should trigger a review of your coverage. These events often require adjustments to your insurance to adequately protect your new circumstances.

3. Quick Checklist for Reviewing Your Coverage:

- Assess Changes: Consider any changes in your home, personal belongings, or lifestyle that have occurred since your last review. Have you made renovations, acquired expensive items, or experienced changes in your family structure?

- Evaluate Coverage Limits: Ensure that the coverage limits on your policy align with the value of your home and possessions. Consider any changes in the replacement cost of your home or the value of your belongings to adjust the coverage limits accordingly.

- Consider Deductible: Evaluate your deductible and assess if it is still appropriate for your financial situation. Adjusting your deductible can impact your premium costs.

- Understand Exclusions: Familiarize yourself with any exclusions or limitations in your policy. Make sure you understand what risks are covered and if there are any additional coverages you may need to add.

- Compare Quotes: Take the opportunity to compare quotes from different insurers to ensure you are getting the best coverage at the most competitive price. Shopping around can help you find potential cost savings or better coverage options.

- Seek Professional Advice: If you are unsure about any aspect of your coverage or need guidance, consider consulting with an insurance broker or agent who can provide expert advice tailored to your needs.

By following this quick checklist and reviewing your coverage regularly, you can ensure that your home insurance policy remains up-to-date, adequately protecting your home and belongings.

Remember, reviewing your coverage is an important part of responsible homeownership and can provide you with peace of mind knowing that you have the appropriate level of protection for your current situation.

7. Consider Insurance Riders

In some cases, certain items in your home, like expensive jewelry or artwork, may require additional coverage beyond what your standard home insurance policy provides. To ensure these high-value possessions are adequately protected, consider adding insurance riders (also known as endorsements) to your policy. Here’s what you need to know:

- What are insurance riders? Insurance riders are additional coverage options that you can add to your existing home insurance policy. They specifically protect high-value items that may exceed the coverage limits of your standard policy. By adding riders, you can ensure that these valuable possessions are fully covered in the event of theft, damage, or loss.

- Why consider insurance riders? Adding insurance riders provides tailored coverage for specific items, allowing you to protect valuable possessions without paying higher premiums for coverage you don’t need. Standard home insurance policies often have coverage limits for certain categories of items, such as jewelry or artwork. Insurance riders offer additional coverage to bridge the gap and provide extra protection for these valuable possessions.

- How to add insurance riders? To add insurance riders, contact your insurance provider and inquire about the process. You may need to provide appraisals, receipts, or documentation of the items you want to insure. The insurer will then assess the value of the items and offer coverage options specifically designed to protect them.

By considering insurance riders, you can ensure that your high-value possessions receive the extra protection they deserve. This way, you avoid the risk of being underinsured and gain peace of mind knowing that your valuable items are adequately covered in the event of unexpected incidents. Contact your insurance provider to discuss adding riders and protect your prized possessions.

If you would like to learn more about Insurance Riders, visit our blog “Understanding Insurance Riders 101“.

8. Ask About Discounts

Don’t be afraid to ask your insurance provider about available discounts. Many insurers offer various discounts that can help you save money on your home insurance. For example, you may be eligible for discounts if you have a monitored security system, if you’re a non-smoker, or if you’re a loyal customer. Inquire about these discounts and take advantage of any that apply to your situation.

Conclusion

Saving money on home insurance is possible for Canadians with a few strategic steps. By shopping around for quotes, bundling policies, increasing your deductible, installing safety measures, maintaining a good credit score, reviewing your coverage, considering insurance riders, and asking about discounts, you can achieve cost savings without compromising on the protection your home needs. Remember to regularly reassess your insurance needs and seek professional advice when necessary to ensure you have the right coverage at the best possible price.

FAQs

Q1: How much can I save by shopping around for home insurance quotes?

The potential savings can vary depending on various factors such as your location, home value, and coverage needs. By obtaining quotes from different insurers, you can compare prices and potentially save hundreds of dollars per year on your home insurance premiums.

Q2: What types of safety measures can help reduce my home insurance premiums?

Installing smoke detectors, security alarms, deadbolt locks, and a sprinkler system are a few examples of safety measures that can lower your insurance premiums. Consult with your insurance provider to determine which safety features qualify for discounts.

Q3: Can maintaining a good credit score really affect my home insurance premiums?

Yes, it can. Insurers consider credit scores as part of their risk assessment. A higher credit score can result in lower insurance premiums, while a lower score may lead to higher premiums. It’s important to maintain good financial habits to keep your credit score in good standing.

Q4: Is it necessary to review my home insurance coverage regularly?

Yes, it is crucial to review your home insurance coverage periodically. Life circumstances change, and so do your insurance needs. By reviewing your coverage, you can ensure that you have adequate protection and avoid overpaying or being underinsured.

Q5: Are there any other ways to save money on home insurance?

In addition to the tips mentioned in this article, you can also consider paying your premiums annually instead of monthly, as some insurers offer discounts for annual payments. Additionally, maintaining a claims-free record and not making small claims can help keep your premiums lower over time.