Before you begin assessing your financial situation in Canada, gathering specific documents and relevant information will ensure a comprehensive evaluation of your finances. Here is a tailored list of things you should prepare and why they are important:

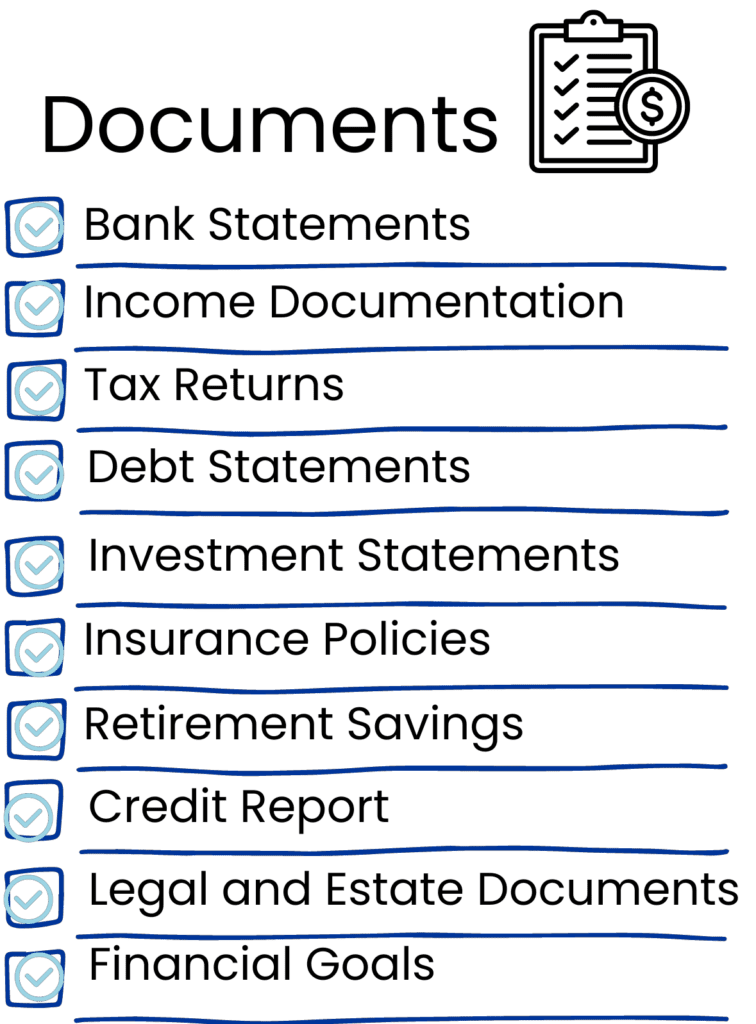

Document Checklist

- Bank Statements: Collect your bank statements for the past 12 months. These statements provide an overview of your income, expenses, and transactions.

- Income Documentation: Gather Canadian pay stubs for the last 6 months or employment contracts that outline your income details. This information helps determine your earning potential and stability.

- Tax Returns: Retrieve your previous 3 years of Canadian tax returns, including supporting documents. These provide insights into your taxable income, deductions, and any outstanding tax obligations.

- Debt Statements: Make a list of all your debts and include statements that cover the current balances, interest rates, and repayment terms. This includes credit card statements, loan agreements, and mortgage statements.

- Investment Statements: Gather the most recent statements for your Canadian investment accounts, including RRSPs, TFSAs, and other investment portfolios. These statements reflect the performance and growth of your investments.

- Insurance Policies: Collect copies of your current Canadian insurance policies, such as health insurance, life insurance, home insurance, and auto insurance. These policies should be up to date and reflect your current coverage.

- Retirement Savings: Obtain statements for your Canadian retirement savings accounts, such as pension plans, RRSPs, or other retirement investment vehicles. These statements should cover the most recent reporting period.

- Credit Report: Request a copy of your Canadian credit report from a major Canadian credit bureau. Review it for accuracy and identify areas that may require attention to improve your credit score.

- Legal and Estate Documents: Retrieve essential Canadian legal documents, such as wills, trusts, powers of attorney, and healthcare directives. Ensure these documents reflect your current wishes and arrangements.

- Financial Goals: Take the time to clarify your short-term and long-term financial goals specific to Canada. Consider factors such as retirement planning, education savings, and the Canadian cost of living when setting your financial objectives.

By preparing these necessary documents and information, you’ll have a solid foundation to assess your financial situation accurately in Canada. It’s important to note that the suggested time lengths for documents may vary depending on individual circumstances and the specific requirements of financial institutions or advisors. Regular assessments and reviews, along with the guidance of a financial advisor, will help you maintain a healthy financial outlook and make informed decisions tailored to your goals.

Time Horizon Considerations

When considering your financial situation, it is important to take into account different time horizons. Each time horizon represents a specific period in the future and requires distinct financial planning strategies. Understanding these time horizons can help you make informed decisions and set appropriate goals. Here are three common time horizons to consider:

Short-Term Financial Goals (1-2 years):

- Emergency Fund: Establish an emergency fund to cover unexpected expenses.

- Debt Repayment: Pay off high-interest debt, such as credit cards or personal loans.

- Budgeting: Create a monthly budget to track income and expenses effectively.

- Savings: Save for specific short-term goals, such as a vacation or down payment.

Medium-Term Financial Goals (3-5 years):

- Education Savings: Start saving for your children’s education or further your own education.

- Homeownership: Save for a down payment on a home or explore affordable housing options.

- Retirement Contributions: Increase contributions to retirement accounts for long-term security.

- Investment Portfolio: Diversify investments and explore opportunities for growth.

Long-Term Financial Goals (10+ years):

- Retirement Planning: Determine a target retirement age and develop a retirement plan.

- Wealth Accumulation: Build substantial savings and investments to achieve financial independence.

- Estate Planning: Create a comprehensive estate plan and consider wills, trusts, and beneficiaries.

- Philanthropy: Establish charitable giving goals and contribute to causes you care about.

Points to Consider:

- Risk Tolerance: Evaluate your risk tolerance for investments and adjust accordingly.

- Tax Planning: Explore tax-efficient strategies to minimize your tax obligations.

- Inflation: Consider the impact of inflation on long-term savings and investment goals.

- Life Events: Anticipate major life events, such as marriage, children, or career changes, and prepare financially.

- Review and Adjust: Regularly review your financial goals and make adjustments as circumstances change.

Remember, setting clear financial goals helps you stay focused, make informed decisions, and achieve financial stability and success. It’s important to regularly reassess your goals, track your progress, and adapt your strategies as needed. Consulting with a financial advisor can provide valuable guidance and support in developing and achieving your financial goals.

Conclusion

Assessing your financial situation in Canada requires thorough preparation and an understanding of the Canadian financial landscape. By following the steps outlined in this tailored number list, you’ll be well-equipped to evaluate your finances effectively. Remember, regular assessment and review are key to maintaining a healthy financial outlook and achieving your financial goals in Canada.

Subscribe below and gain PDF access to an all-inclusive Document Checklist, empowering you to seize control of your financial situation and embark on the journey toward financial freedom:

FAQs

- Do I need to prepare all the mentioned documents specifically for Canada? Yes, it’s important to gather documents that are specific to the Canadian financial system to ensure accurate assessment and evaluation.

- Are there any additional documents I need to prepare as a Canadian resident? While the list covers essential documents, additional documentation may be required based on your individual financial situation. Consulting a Canadian financial advisor can help you determine any additional documents you may need.

- Can I use international financial statements for assessment in Canada? It’s recommended to gather Canadian financial statements to ensure accuracy and relevance within the Canadian financial landscape.

- Are there any Canadian-specific financial tools or resources I should consider? Yes, Canada has specific financial tools and resources available, such as Canadian credit reporting agencies, Canadian tax resources, and retirement savings accounts unique to the Canadian market. Exploring and utilizing these resources can provide valuable insights during your financial assessment in Canada.

- How often should I reassess my financial situation in Canada? It’s advisable to reassess your financial situation at least once a year or whenever there are significant changes in your income, expenses, or financial goals. Regular assessments help you stay on track and make necessary adjustments to achieve financial stability in Canada.

Thanks for sharing this helpful guide! I’ve been looking for a comprehensive resource on how to assess my financial situation and this is exactly what I needed.