In the dynamic world of the financial services industry, chatbots and conversational AI have emerged as intriguing technologies that hold promise for transforming customer interactions. However, it is important to examine their potential benefits and limitations critically. In this article, we will delve into the realm of chatbots in finance, seeking to understand their capabilities and the challenges they may face.

What is a Chat Bot?

A chatbot in the financial industry is a computer program that uses artificial intelligence to have conversations with people. These chatbots are designed to help customers with their financial needs and provide support. Here are some key points to understand about chatbots in finance:

- Instant Help: Chatbots are like virtual assistants that can provide quick answers to common questions about banking, transactions, account balances, and more. You can chat with them using messaging apps, websites, or mobile apps.

- Personalized Assistance: Chatbots can give personalized financial advice based on your needs and goals. They analyze your financial information and suggest budgeting tips, investment options, and ways to manage your money better.

- Automation: They can handle routine tasks, such as transferring funds, paying bills, and checking transaction history. This saves time and makes banking more convenient.

- Security: Chatbots use secure methods to protect your sensitive financial information during conversations and transactions. They follow regulations to ensure your data is kept safe.

- Fraud Detection: Chatbots are programmed to detect suspicious activities and notify you and the bank immediately. This helps in preventing fraud and keeping your accounts secure.

- Learning and Improvement: Chatbots continuously learn from their interactions with users. They get better over time by understanding your preferences and providing more accurate and helpful responses.

- Integration: Chatbots work behind the scenes with banking systems and databases to access your account details and provide you with relevant information.

In summary, chatbots in finance are like assistants that can help you with your banking needs, provide personalized financial advice, automate tasks, and keep your information secure. They are available anytime, anywhere, making banking easier and more convenient for you.

Understanding the Impact of Chat Bots in Finance

In today’s technologically advanced era, chatbots are increasingly being utilized as tools that are reshaping the landscape of the finance industry. With their conversational AI capabilities and integration across multiple channels, chatbots bring forth changes in the delivery of financial services by providing access to a wide range of functionalities that were previously restricted to a dedicated application. By combining human-like interactions with artificial intelligence, these chatbots aim to enhance customer experiences, meet the demands of the modern age, and influence the way financial transactions and interactions occur.

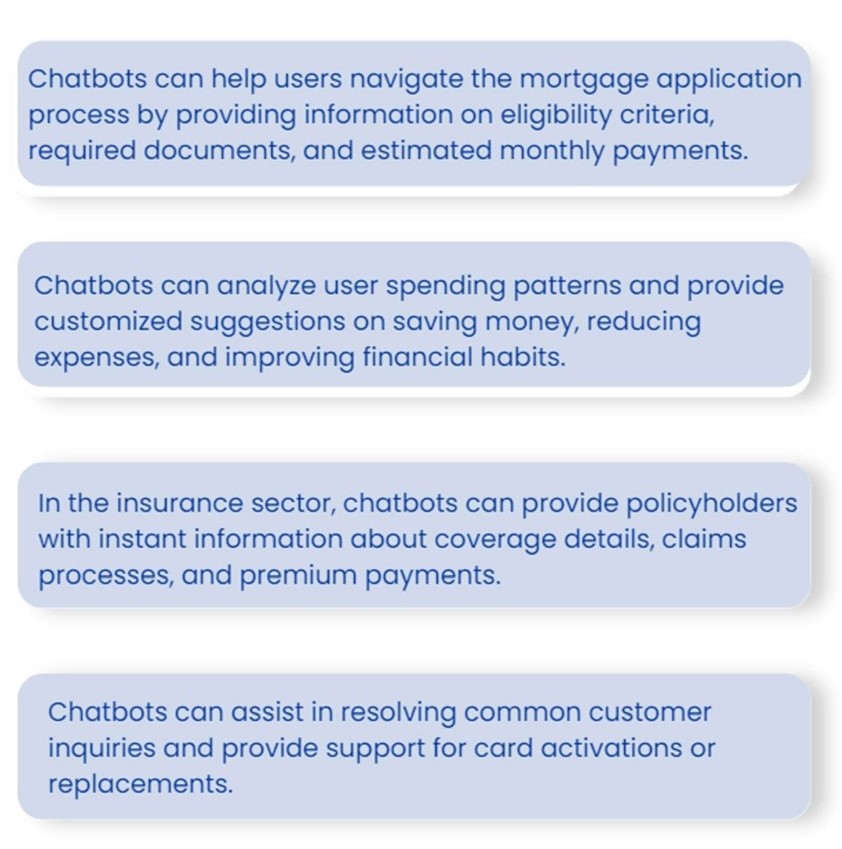

Day-to-Day Examples of Chat Bots in Finance

Benefits of Chat Bots in Finance

- Enhanced Customer Service: Chatbots enable financial firms to provide 24/7 customer support, addressing queries and concerns in real-time. With AI-powered chatbots, customers can receive immediate assistance, enhancing their overall experience.

- Cost Efficiency: By automating customer interactions, financial institutions can significantly reduce operational costs. Chatbots handle repetitive tasks, allowing human agents to focus on more complex and high-value activities.

- Personalization: Advanced chatbot algorithms can analyze customer data and provide personalized recommendations and solutions. This level of customization enhances customer satisfaction and strengthens the relationship between financial firms and their clients.

- Efficient Complaint Handling: Chatbots can efficiently handle customer complaints by offering prompt resolutions or escalating the issue to a human agent when necessary. This ensures timely redressal and improves customer retention.

Limitations and Drawbacks of Chat Bots in Finance

- Test Performance: Chatbots may face challenges performing well on specific tests requiring nuanced understanding or domain-specific knowledge. While they excel in many areas, there could be instances where human agents are better equipped to handle complex inquiries or provide expert advice.

- Relevancy and Applicability: The effectiveness of chatbots relies on the relevancy and applicability of their responses. In some cases, chatbots may provide generic or inaccurate information, leading to frustration for customers. Financial firms need to continuously monitor and update their chatbot algorithms to ensure accurate and relevant responses.

- Implementation and Maintenance: Integrating chatbots into existing systems and ensuring their smooth operation requires careful planning and technical expertise. Financial institutions may face challenges in implementing and maintaining chatbot solutions, including compatibility issues, data integration, and system updates.

- User Acceptance and Trust: Some customers may be hesitant to interact with chatbots, preferring human agents for their expertise and personal touch. Building trust and promoting user acceptance of chatbot technology is an ongoing challenge that financial firms need to address through transparent communication and consistent performance.

Conclusion

In conclusion, chatbots and conversational AI present exciting possibilities for revolutionizing customer interactions within the ever-evolving financial services industry. As we have explored in this article, these technologies offer the potential for enhanced convenience, personalized experiences, and streamlined processes. However, it is crucial to approach their implementation with a critical lens, acknowledging both their benefits and limitations.

While chatbots can automate routine tasks, provide round-the-clock assistance, and handle a wide range of inquiries, they are not intended to replace human agents entirely. Human expertise remains invaluable in addressing complex financial matters and delivering personalized advice. Additionally, ensuring data security and compliance with regulations is of utmost importance to maintain customer trust and protect sensitive information during financial transactions.

As the adoption of chatbots continues to grow, it is essential for financial institutions to carefully consider factors such as user experience, training and fine-tuning of AI algorithms, and ongoing monitoring to address potential biases or inaccuracies. Striking the right balance between automation and human touch is key to providing exceptional customer service and achieving optimal outcomes.

By embracing chatbots and conversational AI responsibly, financial institutions can unlock new opportunities for efficiency, cost reduction, and customer satisfaction. As technology continues to evolve, it will be crucial to stay updated on industry trends, user preferences, and regulatory requirements to harness the full potential of these transformative technologies while mitigating any challenges that may arise.

In conclusion, chatbots are poised to shape the future of customer interactions in the financial services industry, and understanding their capabilities and limitations will enable financial institutions to harness their potential effectively. Through a thoughtful and strategic approach, chatbots can drive innovation, improve operational efficiency, and deliver enhanced experiences for customers in the dynamic landscape of finance.

FAQs

Q1: Are chatbots replacing human agents in the finance industry?

A1: While chatbots are automating routine tasks, they are not replacing human agents entirely. The role of human agents remains vital in handling complex inquiries and providing personalized advice to customers.

Q2: How do chatbots ensure data security in financial transactions?

A2: Chatbots employ encryption and security protocols to protect sensitive customer information during financial transactions. Compliance with data protection regulations, such as GDPR, also contributes to maintaining data security.

Q3: Can chatbots handle complex financial queries effectively?

A3: Advanced AI algorithms empower chatbots to handle complex financial queries by leveraging vast amounts of data and using natural language processing techniques. However, there may be instances where human intervention is required for more intricate matters.

Q4: How do chatbots assist in fraud detection and prevention?

A4: Chatbots continuously monitor transactions, employing machine learning techniques to identify warning signs of fraudulent activity. They promptly notify both the bank and customers, enabling swift action to mitigate potential risks.

Q5: What measures are taken to ensure the accuracy of information provided by chatbots?

A5: Chatbots undergo rigorous training and are regularly updated with the latest financial information to ensure accuracy. They rely on reliable data sources and are designed to provide precise and up-to-date information to customers.

wow, something i learnt something new! Did not think that chatbots played a role in finances. great insight!