The financial industry is a dynamic ecosystem, constantly transforming as it adapts to shifts in technology, policy, and consumer behavior. One of the most significant disruptions in recent years is the introduction of Buy Now, Pay Later (BNPL) services, a novel financial model that is rapidly reshaping the consumer credit market.

BNPL, as the name suggests, provides consumers the flexibility to purchase products or services immediately, but defer the payments to a later date. These payments are typically split into smaller, manageable installments over a set period. More often than not, if the installments are paid on time, consumers can enjoy the benefit of these services interest-free.

The landscape offers a fresh perspective on consumer finance, challenging the longstanding dominance of traditional credit systems. It amalgamates the instant gratification of purchase with the ease of staggered payments, resulting in a powerful tool that has a profound impact on consumers’ purchasing power and spending habits.

This article aims to provide a comprehensive understanding of the Buy Now Pay Later phenomenon, exploring its influence on consumer behavior, the subsequent changes in spending habits, and the potential risks and rewards this new system presents. We will delve into how this innovative financial solution is shaking up the traditional consumer credit market, and how it aligns with contemporary consumer expectations in an increasingly digital age.

Let’s dive into this intriguing world of BNPL services, exploring the ripples it’s creating in the financial ecosystem and the ways consumers can navigate this evolving landscape responsibly.

The Mechanics of BNPL

How does Buy Now Pay Later work? The process is usually straightforward and streamlined for the user’s convenience. At the point of purchase, whether online or in-store, customers select the optimal option for them. After a quick approval process, the customer agrees to a payment schedule. This schedule splits the total cost of the purchase into smaller, more manageable payments, usually spread over weeks or months. There’s no waiting period as with traditional loan approval processes. Instead, the purchase can be completed instantly, giving Buy Now Pay Later a clear advantage in the speed and ease of transaction.

1. Balancing Instant Gratification and Impulsive Spending

Living in an era of click-and-receive convenience, consumers have developed a marked preference for immediate gratification. These services perfectly cater to this desire by facilitating the instantaneous acquisition of products, even if the payment is staggered over a future timeline. The facility to acquire now and pay later feeds into the ‘I want it now’ mentality prevalent among today’s consumers.

While on the surface, this provides a high level of convenience, it comes with its own set of challenges. The primary concern is the potential encouragement of impulsive buying habits. The promise of immediate ownership can create an allure that may lead consumers into hasty purchasing decisions, thereby risking overspending and the unnecessary acquisition of goods.

This facet of services could blur the line between needs and wants, creating a temptation to buy items that might not be necessary or affordable in the long term.

However, managing this balance is not an impossible task. Here are some tips to manage BNPL-induced impulsive spending:

- Needs vs Wants: Before making a purchase, differentiate between what you need and what you want. If an item falls into the ‘want’ category, take a moment to consider if you can afford it without straining your budget.

- Budget Planning: Maintain a strict budget that includes your income, expenses, and savings. Make sure your installments fit into this budget.

- Consider the Total Cost: When looking at the small installments, it’s easy to forget the total cost of the item. Always consider the full price to understand the financial commitment you are making.

- Avoid Late Fees: Ensure you make your BNPL payments on time to avoid late fees, which can quickly add up and strain your finances.

- Limit Use of BNPL: Use BNPL services sparingly and only for items that you need or for high-value purchases that you can comfortably pay in installments.

By adopting these practices, consumers can enjoy the convenience of these types of services while mitigating the risks of impulsive spending and overspending.

2. Navigating Higher Spending and Affordability Perceptions

Buy Now, Pay Later (BNPL) services have revolutionized retail payments by fragmenting larger payments into smaller, manageable installments. This facility may lead consumers to undertake more significant or frequent purchases as products’ costs, when spread over time, appear more affordable.

While this system has its benefits, it’s not without its pitfalls. The increased purchase frequency and perceived affordability offered these services can potentially generate a misleading sense of financial ease. With the perception of lower costs due to smaller payments, consumers may be enticed to spend more than they would typically, resulting in the inadvertent accumulation of debt.

Here are some tips to navigate higher spending and perceptions of affordability with these services:

- Avoid Impulse Purchases: Even though the installment payments are small, the total cost of impulsive purchases can add up quickly. Try to avoid buying items on a whim and focus only on planned purchases.

- Track Your Spending: Regularly monitor your spending on BNPL platforms. This will help you keep track of your financial obligations and avoid overspending.

- Assess Affordability Based on Full Price: Don’t let the smaller installments trick you into thinking a product is more affordable. Always consider the full price of the item to assess its affordability.

- Use BNPL for Larger Purchases: BNPL can be especially useful for larger, necessary purchases. This allows you to spread the cost over time without straining your budget.

- Set a BNPL Budget: Set a monthly limit for your BNPL spending. This will help you avoid getting caught in a cycle of debt.

By following these guidelines, consumers can leverage the convenience and flexibility of BNPL services while maintaining a responsible handle on their finances.

3. Consumer Confidence in High-Value Purchases and Debt Risks

One significant benefit of these services is their ability to facilitate high-value purchases. By breaking down large purchase prices into smaller, more manageable payments, these services have expanded the purchasing power of consumers. This added flexibility means consumers can invest in quality products without immediate financial stress.

However, this facility also comes with its set of challenges. The ease of making large purchases can indeed act as a double-edged sword. On one hand, it offers the possibility of owning high-quality goods; on the other, it carries the risk of over-commitment to ongoing installments. This situation, if not handled correctly, might lead consumers down a cycle of continuous debt.

To mitigate these risks and effectively leverage the benefits of Buy Now, Pay Later services, consider the following tips:

- Evaluate Your Financial Capacity: Before making a high-value purchase, consider your ability to handle the ongoing installments in addition to your other financial commitments.

- Don’t Overcommit: Avoid making multiple high-value purchases at the same time. This can prevent overcommitment of your future income.

- Consider Long-term Implications: Remember that with these services, you are committing to a future payment. Ensure that you will have the means to fulfill these obligations in the long term.

- Emergency Savings: Keep an emergency savings account. If you face unexpected expenses, this fund can help you keep up with your BNPL installments without additional borrowing.

- Use BNPL Responsibly: BNPL is a tool that should be used responsibly. Use it to your advantage, but avoid falling into the trap of unnecessary debt.

By adhering to these guidelines, consumers can confidently make high-value purchases using these services without falling into a potentially harmful debt cycle.

4. Budgeting Implications and Financial Management Challenges

The installment structure central to BNPL services demands careful budgeting to accommodate future repayments. On the positive side, this requirement can instill a sense of financial discipline among consumers, making them more mindful of their spending habits.

However, it’s not without its challenges. The comfort of paying for purchases in small, staggered payments might cause consumers to underestimate their total financial commitments. This perception can create complications, possibly straining their financial planning and leading to an over-commitment of future income.

Here are some tips for consumers to manage BNPL payments and avoid the risks of over-commitment:

- Keep Track of Your Installments: Regularly review these accounts to stay updated on upcoming installments. This will prevent any surprises and keep you prepared for upcoming payments.

- Incorporate BNPL Payments in Your Budget: When planning your budget, ensure you include your Buy Now, Pay Later installments. This will give you a clear picture of your monthly financial commitments.

- Plan for the Total Cost: Don’t be swayed by the small installments. Always remember that you’re committing to pay the total cost of the item.

- Avoid Multiple BNPL Commitments: Limit the number of BNPL commitments at a given time. Managing multiple payments can be challenging and increase the risk of missed or late payments.

- Prioritize Repayments: Make sure your BNPL payments are a priority. Late payments can lead to extra charges and impact your credit score.

By following these strategies, consumers can successfully leverage the advantages of BNPL services while avoiding the pitfalls of over-commitment and financial strain.

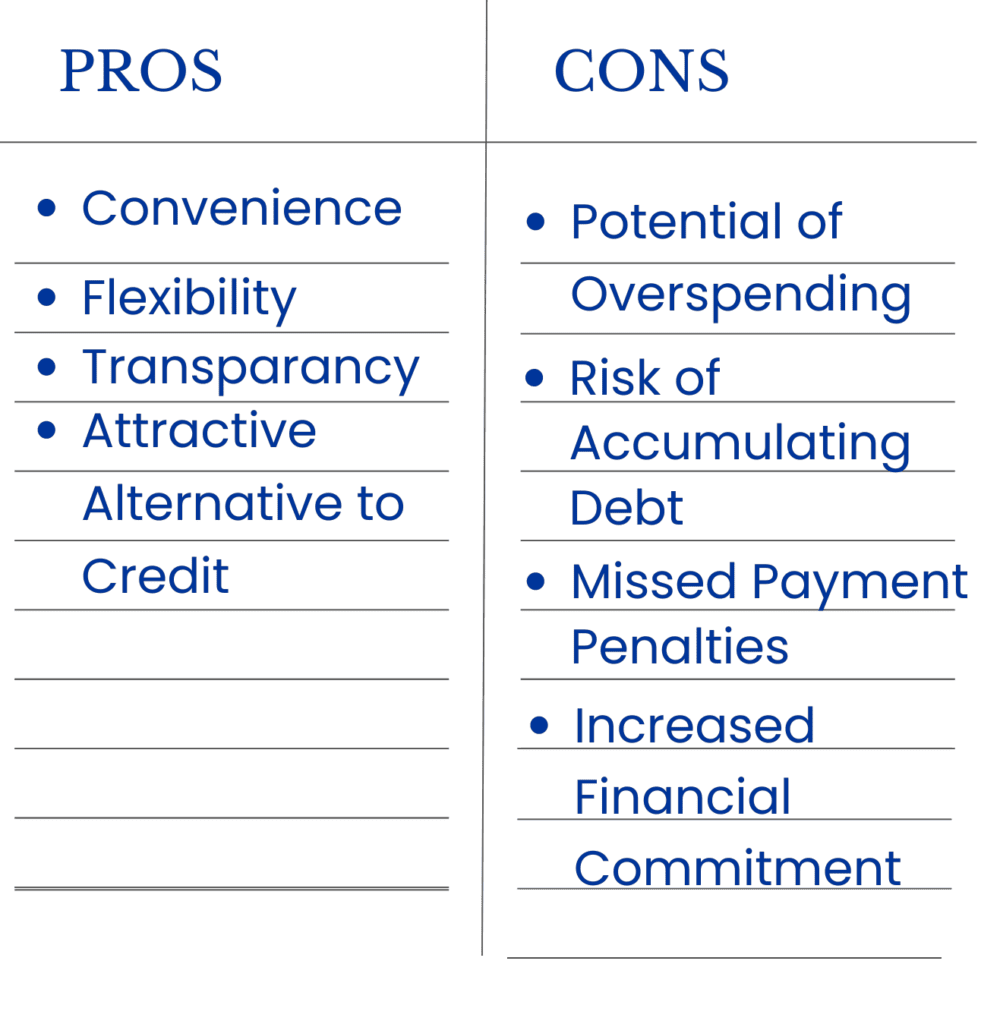

Paradigm Shift in Shopping Experience: Understanding the Pros and Cons

Buy Now, Pay Later (BNPL) services represent a significant shift in the shopping experience, introducing a new model of convenience, flexibility, and transparency in payments. This change, particularly favored by younger consumers, offers a fresh alternative to traditional credit facilities.

However, like every financial model, BNPL has its benefits and potential drawbacks. Here’s a more detailed look at the pros and cons of this transformative service:

Pros of BNPL Services:

- Convenience: BNPL services make purchasing easy and quick. They allow consumers to take home products or use services immediately, despite a postponed payment timeline.

- Flexibility: With BNPL, consumers have the option to split the payment into smaller, more manageable installments. This provides increased financial flexibility.

- Transparency: BNPL services provide clear, upfront information about the installment schedule and any associated fees, making it a user-friendly option.

- Attractive Alternative to Credit: BNPL is seen as an attractive alternative to traditional credit cards or loans, with easier approval and straightforward repayment plans.

Cons of BNPL Services:

- Potential for Overspending: The convenience and simplicity of BNPL could lead consumers to overspend, as they may be tempted to buy more than they need or can afford.

- Risk of Accumulating Debt: The ease of BNPL can blur the lines of financial commitment, potentially encouraging consumers to take on more debt without fully considering the implications.

- Missed Payment Penalties: Late or missed payments could incur fees and affect the consumer’s credit score, similar to traditional credit facilities.

- Increased Financial Commitment: With each BNPL purchase, consumers commit a portion of their future income to repayments. Too many BNPL obligations can strain their budget.

Conclusion

As we delve deeper into the 21st century, the financial world continues to evolve, introducing new tools and services that fundamentally alter the landscape of consumer spending. BNPL services are a prime example of this ongoing transformation, challenging traditional payment and credit systems with their unique blend of flexibility, convenience, and immediacy.

The implications of BNPL services are profound, shifting the paradigm of consumer shopping experiences, impacting consumer habits, spending behaviors, and necessitating a fresh approach to financial planning. While these services cater to modern consumers’ cravings for instant gratification, they also run the risk of promoting impulsive spending and the potential accumulation of unneeded debt.

By transforming daunting, large payments into smaller, digestible installments, BNPL services can embolden consumers to make higher-value purchases. But this perceived affordability also poses risks, potentially leading to increased financial commitment and strain on consumers’ budgets.

Like any financial service, the key to successfully navigating the BNPL landscape lies in understanding and managing these inherent risks. Consumers must maintain financial discipline, carefully planning for future repayments, and keeping track of their commitments to avoid overstretching their resources.

Ultimately, BNPL services represent another step in the continual evolution of consumer finance. As with any financial tool, the benefits can be significant when used responsibly, and potential pitfalls can be avoided with adequate knowledge, planning, and restraint. As consumers and financial professionals alike continue to navigate this evolving landscape, a thoughtful and informed approach will be vital to ensure these new tools serve as beneficial aids rather than burdensome liabilities.

FAQs

- What is BNPL?

- Buy Now, Pay Later (BNPL) is a financial service that allows consumers to make purchases immediately and pay for them over a set period in installments.

- How does BNPL influence consumer spending?

- BNPL can potentially increase consumer spending by offering perceived affordability and catering to the desire for immediate gratification. However, it might also lead to impulsive buying and overspending.

- How does BNPL impact financial management?

- While BNPL necessitates planned budgeting due to the recurring payment schedule, it could also potentially lead to financial overcommitment if not properly managed.

- How is BNPL different from traditional credit options?

- BNPL services typically offer more straightforward, transparent processes with defined installment plans. However, the ease of use might inadvertently encourage consumers to undertake more debt without understanding the potential implications.

Additional Resources

For those wishing to delve deeper into the Buy Now, Pay Later (BNPL) landscape, the following resources are invaluable:

Wealth Solutions Hub:

“Banks: Still a Missing Link in BNPL? What Will It Take For Them to Seize the Opportunity?” on Forbes