This Canadian Guide to Will and Estate Planning will assist you in managing and distributing assets after death. It is an essential part of financial planning that ensures a person’s wishes are followed and their loved ones are taken care of. A will, a legal document outlining the distribution of assets, is a key component of estate planning in Canada. In this comprehensive guide, we will delve into the importance of estate planning, the components of an estate plan, the significance of a will, and the process of creating a valid will in Canada.

Importance of Estate Planning

Regardless of age, health, or wealth, estate planning is essential for everyone. It goes beyond asset distribution after death and encompasses considerations for the future needs of loved ones, protection of assets from creditors and taxes, and ensuring medical and financial decisions align with personal wishes. Estate planning can also help prevent family conflicts and reduce stress during an already challenging time. By having an estate plan in place, individuals can take control of their legacy and ensure assets are distributed according to their values and priorities.

The Process of Creating a Will

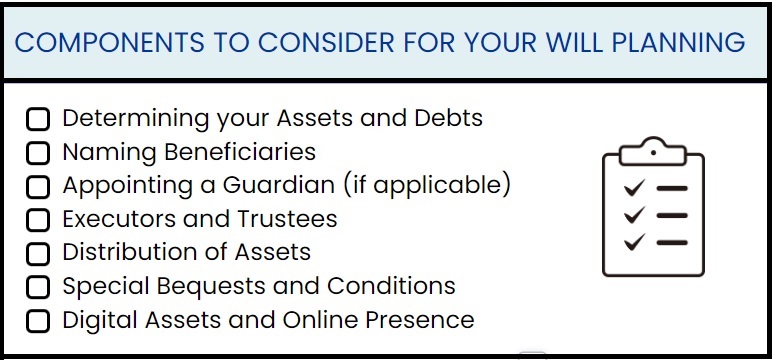

Creating a will involves several crucial steps to ensure it accurately reflects your intentions and desires. Following a systematic approach can help you create a comprehensive and legally valid will.

Determining your Assets and Debts

When it comes to estate planning, one crucial step is to accurately assess your assets and debts. This comprehensive guide will walk you through the process, making it easier and visually appealing, ensuring that you have a clear understanding of your estate’s composition and can make informed decisions.

- Create an Inventory: Begin by creating a detailed inventory of all your assets. This includes:

- Real Estate: Note down any properties you own, their locations, and estimated values.

- Investments: List all your investment accounts, stocks, bonds, mutual funds, and their approximate worth.

- Bank Accounts: Record the names of the banks where you hold accounts, along with the account numbers.

- Insurance Policies: Include life insurance policies, health insurance, and any other relevant coverage.

- Personal Belongings: Take note of valuable personal items such as jewelry, artwork, or collectibles.

- Identify Debts: It’s equally important to list your outstanding debts, as they affect your overall estate. Consider the following:

- Mortgages: Document any mortgages on your properties, including the outstanding balances.

- Loans: Include any loans you’ve taken, such as car loans, student loans, or personal loans.

- Credit Card Balances: Make a note of any outstanding balances on your credit cards.

- Other Debts: Don’t forget to include any other debts, such as outstanding medical bills or tax liabilities.

- Organize and Review: Once you’ve gathered all the necessary information, organize it in a clear and easily accessible format. Consider using a spreadsheet or dedicated estate planning software to keep everything in order. This will help you review and analyze your assets and debts more efficiently.

- Seek Professional Guidance: While this guide provides a solid foundation, it’s always advisable to seek professional guidance from an estate planning expert or a financial advisor. They can offer personalized advice based on your unique circumstances and ensure that nothing is overlooked.

By following these steps and having a comprehensive understanding of your assets and debts, you’ll be better equipped to make informed decisions when creating your estate plan. Remember, estate planning is a crucial process, and knowing your financial landscape is the first step toward securing your legacy.

Naming Beneficiaries and Executors

One crucial aspect of estate planning is carefully selecting beneficiaries and executors to safeguard your assets and ensure your wishes are fulfilled. This comprehensive summary will guide you through this important step, making it easier and more accessible to understand and implement.

- Identifying Beneficiaries: Take the time to consider who you want to inherit your assets and properties. This includes not only immediate family members but also close friends or charitable organizations that hold a special place in your heart. Think about your values, goals, and the impact you want to leave behind when making these decisions.

- Choosing an Executor: An executor plays a vital role in managing your estate and ensuring your wishes are carried out efficiently. Selecting a trustworthy and capable individual is crucial. Consider someone who is organized, responsible, and has a good understanding of financial matters. It’s also wise to have an alternate executor in case your primary choice is unable to fulfill their duties.

- Communicating Your Intentions: Once you have made these decisions, it’s essential to communicate your intentions clearly. Discuss your choices with your beneficiaries and potential executors, explaining your reasoning and ensuring everyone understands your wishes. Open and honest communication can help prevent misunderstandings or conflicts in the future.

- Reviewing and Updating: As circumstances change over time, it’s important to regularly review and update your beneficiary and executor choices. Life events such as marriages, divorces, births, or the passing of loved ones may require adjustments to your estate plan. Stay proactive and ensure your plan accurately reflects your current desires.

By following these steps and giving careful consideration to naming beneficiaries and executors, you can create a solid foundation for your estate plan. Remember, seeking professional advice from an estate planning attorney or advisor can provide invaluable guidance tailored to your specific needs and goals.

Appointing a Guardian (if applicable)

For Canadian parents with minor children, one crucial aspect of estate planning is appointing a guardian who will assume responsibility for their well-being in the unfortunate event of your passing. This process requires careful consideration and selection of an individual who not only shares your values but also possesses the ability to provide a loving and nurturing environment for your children.

- Choosing the Right Guardian: Selecting a guardian is a decision that should not be taken lightly. Consider individuals who have a close relationship with your children and demonstrate a genuine commitment to their welfare. It’s important to choose someone who shares your parenting philosophy, values, and beliefs, ensuring a seamless transition for your children during a challenging time.

- Assessing Financial Considerations: While the emotional and physical care of your children is paramount, it’s also crucial to evaluate the financial aspects associated with their upbringing. Discuss the financial responsibilities involved with potential guardians to ensure they are capable of providing for your children’s needs. This may include education expenses, healthcare costs, and general day-to-day living expenses.

- Formalizing the Appointment: Once you have identified a suitable guardian, it’s essential to formalize the appointment legally. Consult with an estate planning attorney who specializes in family law to ensure the necessary documentation, such as a will or guardianship designation, is in place. This legal framework will provide clarity and ensure your wishes regarding your children’s care are upheld.

- Ongoing Communication: As your children grow and circumstances change, it’s important to maintain open lines of communication with the appointed guardian. Regularly discuss your expectations, desires, and any updates or changes that may arise. This ongoing dialogue will help the guardian understand your evolving intentions and provide for the best interests of your children.

Appointing a guardian for your minor children is a crucial step in protecting their well-being. By thoughtfully considering your options and working closely with legal professionals, you can ensure that your children are cared for by someone you trust, giving you peace of mind and reassurance about their future.

Please note that the information provided is intended as a general guide and should not substitute professional legal advice. Consult with an estate planning attorney to address your specific circumstances and requirements.

Key Components of a Will

A well-drafted will should cover various important components to ensure that your estate is distributed according to your wishes. Some key components include:

Executors and Trustees

Executors are responsible for administering your estate and carrying out the instructions outlined in your will. They handle tasks such as gathering assets, paying off debts, and distributing assets to beneficiaries. Trustees, on the other hand, manage any trusts established in your will, ensuring that the assets held in trust are properly managed and distributed to beneficiaries over time.

Distribution of Assets

Specify how your assets and properties should be distributed among your beneficiaries. You can allocate specific assets or designate a percentage share to each beneficiary. Consider factors such as the needs and circumstances of your beneficiaries while making these decisions.

Special Bequests and Conditions

If you wish to make specific bequests, such as leaving sentimental items or charitable donations, outline them clearly in your will. Additionally, you can include conditions or restrictions on the distribution of assets, ensuring that they are used for specific purposes or reach certain milestones.

Digital Assets and Online Presence

In today’s digital age, it’s crucial to consider your online presence and digital assets in your estate plan. Include instructions on how to access and manage your digital accounts, social media profiles, and online assets to prevent loss or unauthorized access.

Estate Taxes and Probate in Canada

Understanding estate taxes and the probate process is essential for effective estate planning in Canada.

Understanding Estate Taxes in Canada

In Canada, there is no federal inheritance tax. However, there may be taxes imposed on the deemed disposition of assets upon death, known as the “capital gains tax.” This tax is calculated based on the increase in value of certain assets from the time they were acquired until the time of death. It’s important to consult with a tax professional to understand the tax implications specific to your situation.

Reducing Estate Taxes in Canada

There are strategies available in Canada to minimize the impact of estate taxes. These may include utilizing tax-efficient investments, making charitable donations, and implementing estate freeze techniques. Working closely with a qualified tax advisor or estate planning lawyer can help you navigate the complexities of estate taxation and develop strategies to reduce the tax burden on your estate.

The Probate Process in Canada

Probate is the legal process in which a will is validated and the distribution of assets is overseen by the court. In Canada, probate rules and requirements vary by province or territory. Generally, it involves submitting the will, proving its authenticity, and obtaining a Grant of Probate. The executor named in the will is responsible for initiating the probate process. It’s important to consult with a lawyer who specializes in estate administration to ensure compliance with the specific probate rules in your province or territory.

Planning for Incapacity in Canada

Estate planning is not only about preparing for the distribution of assets after death but also addressing potential incapacity during your lifetime. Planning for incapacity involves:

Powers of Attorney in Canada

Granting a Power of Attorney (POA) in Canada allows you to appoint someone you trust to make financial and legal decisions on your behalf if you become incapacitated. There are different types of POAs, including Continuing Power of Attorney for Property and Power of Attorney for Personal Care. These documents ensure that your financial and personal affairs are managed according to your wishes.

Representation Agreements in Canada

In Canada, Representation Agreements are legal documents that allow you to appoint someone to make healthcare and personal care decisions on your behalf if you are unable to do so yourself. Representation Agreements can be specific to healthcare decisions or can cover a broader range of personal care matters. They provide clear instructions and authority for your representative to act in your best interest.

Advance Care Directives in Canada

Advance Care Directives, also known as living wills, allow you to express your preferences regarding medical treatment and end-of-life care in Canada. These documents outline your wishes regarding life-sustaining measures, resuscitation, organ donation, and other medical interventions. Advance Care Directives guide healthcare providers and your loved ones in making decisions aligned with your values and beliefs.

Updating and Reviewing Your Will in Canada

Creating a will is not a one-time task. It’s important to regularly review and update your will to reflect any changes in your life circumstances or wishes.

Life Changes and Will Updates in Canada

Significant life events such as marriage, divorce, the birth of a child, or the acquisition of new assets may necessitate updates to your will. Regularly reviewing your will ensures that it accurately reflects your current situation and desires.

Regularly Reviewing Your Estate Plan in Canada

In addition to updating your will, it’s important to review your entire estate plan periodically. This includes reviewing beneficiary designations on insurance policies and retirement accounts, assessing the need for trusts, and confirming the adequacy of your estate planning.

Seeking Professional Help for Estate Planning in Canada

Estate planning can be complex, and seeking professional help from experts in the field is highly recommended to ensure your wishes are properly documented and your assets are protected.

Importance of Legal and Financial Advice in Canada

Consulting with an experienced estate planning lawyer and a knowledgeable financial advisor who specialize in Canadian laws and regulations is crucial. They can provide personalized advice, ensure legal compliance, and help you navigate the intricacies of estate planning specific to Canada.

Working with Estate Planning Professionals in Canada

Estate planning professionals can assist you in creating a comprehensive estate plan that aligns with Canadian laws and regulations. They will consider your unique circumstances and goals, providing tailored solutions to protect your assets, minimize taxes, and provide for your loved ones.

Frequently Asked Questions (FAQs)

- Is estate planning necessary for Canadians with small estates? Yes, estate planning is important regardless of the size of your estate. It allows you to control the distribution of your assets, appoint guardians for minor children, and plan for incapacity.

- Can I create my own will without professional assistance in Canada? While it’s possible to create a basic will using online templates, seeking professional advice is highly recommended to ensure your will complies with Canadian laws and accurately reflects your wishes.

- Do I need to update my will if I move to a different province in Canada? It’s advisable to review and update your will if you relocate to a different province or territory in Canada. Laws regarding wills and estate planning can vary, and ensuring compliance with the specific regulations in your new jurisdiction is important.

- What happens if I don’t have a Power of Attorney in place and become incapacitated in Canada? Without a Power of Attorney, the court may need to appoint a guardian to manage your affairs if you become incapacitated. This process can be time-consuming, costly, and may not align with your wishes. Having a Power of Attorney in place allows you to choose someone you trust to handle your affairs.

- Can I include digital assets in my will in Canada? Yes, you can include instructions for the management and distribution of digital assets in your will. Be specific about the assets, provide necessary access information, and consider the evolving nature of digital assets when updating your will.

Additional Resources

Estate planning and wills can be complex, and it is essential to seek professional advice to ensure that your estate plan will meet your needs and comply with provincial legislation. The following resources may be helpful:

- Canadian Bar Association (CBA): Visit the CBA website for legal guidance on estate planning and wills. Gain insights, access articles, and connect with specialized legal professionals.

- Investopedia: Estate Planning for Canadians: Explore Investopedia’s dedicated section for concise information on wills, trusts, and taxes related to estate planning in Canada.

- Canada Revenue Agency (CRA): What to Do Following a Death: Refer to the comprehensive guide by the Canada Revenue Agency for understanding tax obligations, benefits, and finalizing affairs after a loved one’s passing.

Conclusion

Estate planning and wills in Canada are essential components of financial planning. They allow individuals to take control of their legacy, ensure that their assets are distributed according to their wishes, and protect their loved ones. It is essential to seek professional advice to ensure that your estate plan and will meet your needs and comply with provincial legislation. By taking the time to create an estate plan and will, you can have peace of mind knowing that your wishes will be followed after your death.

Great article! Very helpful, practical and informative