Central Bank Digital Currency (CBDC) has emerged as a prominent topic in the realm of digital finance. As governments and central banks worldwide consider the adoption of CBDC, it is essential to understand its intricacies and the potential impact it may have on our everyday lives. This comprehensive guide aims to provide detailed information about CBDC in Canada, shedding light on its implications and offering insights on how individuals can get involved in the process.

Introduction to Central Bank Digital Currency

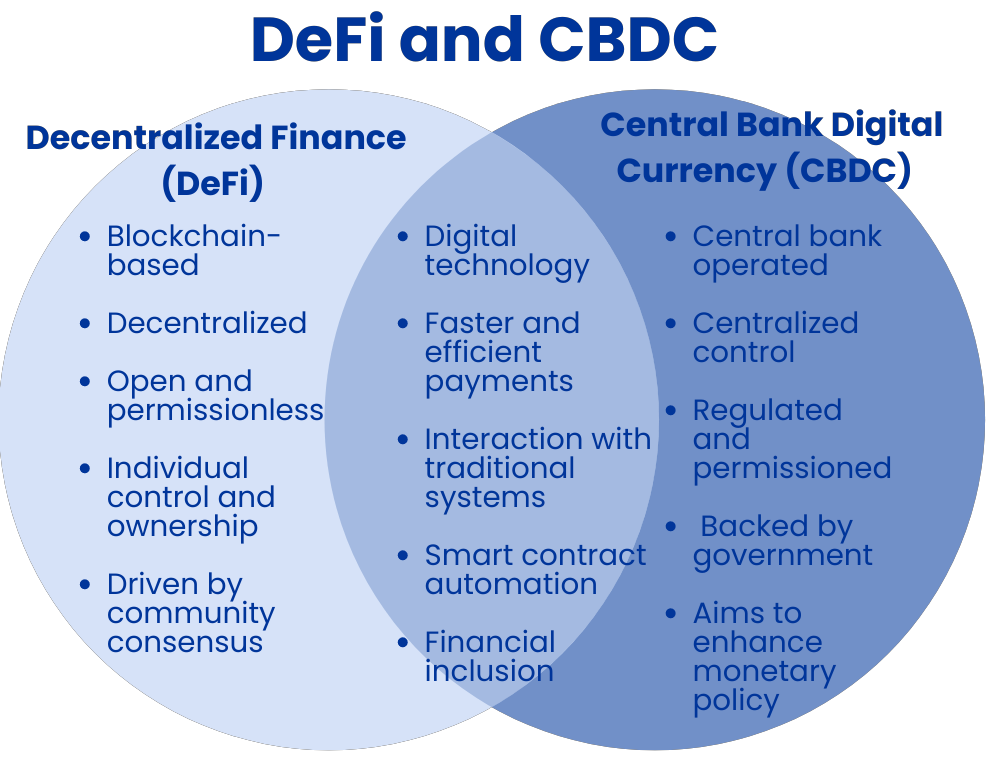

Central Bank Digital Currency (CBDC) is a form of digital currency issued and regulated by a country’s central bank. It serves as a digital representation of the nation’s fiat currency, such as the Canadian dollar (CAD). Unlike decentralized cryptocurrencies, CBDC is centralized and operates within existing financial systems.

CBDC, or Central Bank Digital Currency, operates on advanced technologies such as blockchain or distributed ledger technology (DLT) to enable secure transactions and recordkeeping. It serves as a digital representation of a country’s fiat currency, like the Canadian dollar (CAD).

How Central Bank Digital Currency Works

CBDC functions as a digital form of money issued and regulated by the central bank. It can be accessed through digital wallets or mobile applications, similar to online banking or payment apps. These digital wallets store the CBDC units, allowing users to send, receive, and store their digital currency securely.

When a CBDC transaction takes place, the information is recorded on a decentralized ledger, like a blockchain. This ledger serves as a transparent and tamper-proof record of all CBDC transactions. It ensures the integrity of the currency and prevents double-spending, where someone attempts to spend the same CBDC unit more than once.

CBDC can be used for a wide range of transactions. Users can make peer-to-peer payments directly from their digital wallets to another individual’s wallet. It eliminates the need for intermediaries, such as banks or payment processors, making transactions faster and potentially more cost-effective.

In addition to peer-to-peer payments, CBDC can be used for online purchases. Users can shop on websites or mobile apps that accept CBDC as a form of payment. The transaction process is similar to traditional online payment methods, but instead of using a credit card or bank transfer, users utilize their CBDC units to complete the purchase.

CBDC is not limited to online transactions only. It can also be used for offline transactions, even in situations where an internet connection is not available. Digital wallets can store CBDC offline and use Near Field Communication (NFC) or other technologies to enable contactless payments. Users can make purchases at physical stores or even transfer CBDC units to other individuals in close proximity.

Implications of Central Bank Digital Currency on Personal Finance

The introduction of CBDC, or Central Bank Digital Currency, is expected to bring significant changes to day-to-day financial interactions for Canadians. Let’s explore specific aspects of personal finance that may be affected, changed, or heightened by the adoption of CBDC:

- Payment Methods: With CBDC, Canadians will have an additional digital payment method available. They can use CBDC for various day-to-day transactions, such as purchasing goods and services, paying bills, and transferring funds. This may lead to an increased reliance on digital payment methods and a potential decline in cash usage.

- Speed and Convenience: CBDC transactions can offer faster and more convenient experiences compared to traditional payment methods. Payments can be made instantly, reducing the need for manual processing and waiting times. Individuals can make quick purchases, settle bills promptly, and send/receive funds without delays caused by intermediaries.

- Peer-to-Peer Transactions: CBDC facilitates direct peer-to-peer transactions without the involvement of intermediaries like banks or payment processors. Individuals can transfer funds directly from their digital wallets to others, making it easier to split bills, repay debts, or share expenses among friends, family, or colleagues.

- E-commerce: CBDC can revolutionize online shopping experiences. Consumers can make secure and seamless purchases on e-commerce platforms, leveraging the convenience of digital wallets to complete transactions efficiently. The potential integration of CBDC into online marketplaces may enhance transaction speed and reduce the need for entering sensitive financial information repeatedly.

- Contactless Payments: CBDC can enable contactless payments through digital wallets or mobile devices equipped with Near Field Communication (NFC) technology. Canadians can simply tap their devices to pay at physical stores, public transportation systems, or vending machines, eliminating the need for physical cards or cash.

- Financial Inclusion: CBDC has the potential to promote financial inclusion by providing digital payment services to unbanked or underbanked individuals. With access to CBDC-enabled digital wallets, individuals who previously faced barriers to traditional banking can participate in the digital economy, perform transactions, and manage their finances more efficiently.

- Recordkeeping and Budgeting: CBDC transactions leave a digital trail, facilitating more accurate recordkeeping and budget management. Users can easily track their expenses, review transaction histories, and analyze spending patterns through digital wallet applications or financial management tools. This increased visibility can help individuals make more informed financial decisions.

- Security and Fraud Prevention: CBDC transactions can offer enhanced security features compared to cash transactions. Advanced encryption and authentication technologies help protect against fraud and unauthorized access. However, users must remain vigilant in safeguarding their digital wallets and personal information to mitigate potential risks.

It’s important to note that the impact of CBDC on day-to-day interactions will depend on factors such as technological implementation, user adoption, and regulatory frameworks. As CBDC becomes more integrated into financial systems, Canadians will experience a shift towards digital payment methods, increased convenience, and new opportunities for managing their finances efficiently.

Political Implications Central Bank Digital Currency

The introduction of CBDC, or Central Bank Digital Currency, will not only affect day-to-day financial interactions for Canadians but also carry political implications. Let’s explore how CBDC can impact specific aspects of personal finance and highlight its political ramifications:

- Government Surveillance and Privacy: The implementation of CBDC raises concerns about government surveillance and privacy. CBDC transactions leave a digital trail that can be monitored by central banks or regulatory authorities. While this may aid in combating illicit activities, such as money laundering and terrorism financing, it also raises questions about the extent of government oversight and individual privacy.

- Financial Inclusion and Social Equity: CBDC has the potential to contribute to financial inclusion by providing access to digital payment services for individuals who currently have limited access to traditional banking services. This may align with efforts to promote social equity and reduce financial disparities. Policymakers can consider the option of offering digital wallets and enabling CBDC usage as a means to enhance financial access and bridge socioeconomic gaps. However, it is important to critically evaluate the effectiveness of such measures and their impact on addressing social inequities.

- Monetary Policy and Economic Stimulus: CBDC allows central banks to have more direct control over monetary policy and economic stimulus measures. By monitoring CBDC transactions, central banks can gain real-time insights into economic trends, consumer behavior, and spending patterns. This information can inform policy decisions, such as adjusting interest rates or implementing targeted economic stimulus measures.

- Political Stability and Financial Sovereignty: The adoption of CBDC has the potential to impact political stability and enhance financial sovereignty for governments. By considering CBDC implementation, countries can potentially decrease reliance on foreign payment systems or digital currencies, aiming to maintain a greater degree of control over their financial systems. This could be seen as a strategy to reduce potential vulnerabilities to external economic influences. It is important, however, to examine the influence of various factors, including potential risks and challenges, as well as the influence of organizations such as the World Economic Forum (WEF) on CBDC development and adoption.

- Government Digital Identity Programs: CBDC implementation may coincide with government initiatives for digital identity programs. These programs can provide individuals with a unique digital identity linked to their CBDC wallet, enabling secure and authenticated transactions. However, the political implications of these programs include concerns about data privacy, surveillance, and potential misuse of personal information.

It is essential for policymakers to consider the political implications of CBDC implementation, balancing the goals of financial inclusion, privacy protection, economic stability, and national sovereignty. Striking the right balance between government oversight, individual privacy, and public trust will be crucial in shaping the political landscape surrounding CBDC and its impact on day-to-day finances.

Striking a Balance: Safeguards and Individual Responsibilities in the Age of CBDC

Balancing the convenience aspect of Central Bank Digital Currency (CBDC) with the potential for overreliance on a centralized body, such as the government, requires both systemic safeguards and individual responsibility. While robust governance frameworks and transparency are essential, individuals can also take certain steps to ensure they are not overly dependent on centralized power for the sake of convenience. Here are some self-responsibilities individuals can undertake:

- Diversify Payment Methods: Explore and utilize a variety of payment options beyond CBDC, such as traditional banking services, decentralized cryptocurrencies, or alternative digital payment platforms.

- Protect Personal Data: Take measures to safeguard personal information by using strong passwords, enabling two-factor authentication, and being cautious about sharing sensitive data with untrusted sources.

- Stay Informed: Continuously educate oneself about the risks, benefits, and implications of CBDC and closely monitor any changes or updates in its implementation to make informed decisions.

- Support Decentralized Systems: Engage with decentralized technologies and platforms that prioritize user control, privacy, and data ownership, reducing reliance on centralized intermediaries.

- Advocate for Privacy Rights: Actively participate in discussions, public consultations, or advocacy groups that promote privacy, data protection, and individual rights in the digital sphere.

- Demand Transparency and Accountability: Encourage government and regulatory bodies to provide clear guidelines, regular audits, and independent oversight of CBDC operations to prevent abuse of power and ensure accountability.

- Promote Financial Literacy: Develop a strong understanding of financial concepts and digital payment technologies to navigate the evolving landscape confidently and make informed choices.

By combining systemic safeguards with individual responsibilities, it is possible to strike a balance between the convenience of CBDC and maintaining a healthy level of autonomy and resilience in the digital financial ecosystem.

International Perspectives on CBDC

CBDC has captured significant attention on the global stage, as numerous countries are actively exploring its potential implementation. The international community recognizes the importance of collaboration and the sharing of best practices to shape the future of CBDC. Countries engage in discussions, forums, and collaborative initiatives to exchange knowledge, experiences, and insights related to CBDC.

International organizations, such as the International Monetary Fund (IMF), the Bank for International Settlements (BIS), and the World Economic Forum (WEF), play pivotal roles in fostering dialogue and facilitating cooperation among nations. These organizations provide platforms for policymakers, central banks, and experts to share their research, findings, and recommendations on CBDC-related matters.

Countries participate in pilot programs and experimental projects to assess the potential benefits, challenges, and implications of CBDC adoption. These initiatives often involve collaboration between central banks, financial institutions, and technology providers. Pilot programs enable countries to conduct real-world testing, gather valuable data, and evaluate the feasibility and effectiveness of CBDC in various contexts.

The exchange of experiences and lessons learned between countries is crucial in informing CBDC development and policy decisions. This includes discussions on technical considerations, regulatory frameworks, interoperability, security standards, and user experience. By examining different approaches and outcomes, countries can make more informed choices and tailor CBDC implementations to suit their specific economic, social, and cultural contexts.

How Individuals Can Get Involved

Individuals have opportunities to actively engage and contribute to the CBDC process. Staying informed about CBDC developments is key, and individuals can do so by accessing official communications from central banks and relevant regulatory authorities. These sources provide updates, reports, and research publications on CBDC-related topics, shedding light on progress, challenges, and policy considerations.

Participating in public consultations organized by central banks or governmental agencies allows individuals to share their perspectives, concerns, and suggestions regarding CBDC. Such consultations may involve surveys, online forums, or town hall meetings to gather public input. By voicing opinions and providing feedback, individuals can influence the direction and design of CBDC policies, ensuring that diverse viewpoints are considered.

Familiarizing oneself with digital wallets, mobile payment applications, and other digital payment technologies is beneficial in preparing for the potential adoption of CBDC. Acquiring knowledge about how these technologies work, understanding security features, and staying updated on developments in the digital payments ecosystem can help individuals adapt to and utilize CBDC effectively.

Education and awareness initiatives led by central banks and industry organizations can also provide individuals with resources and guidance on CBDC. These initiatives aim to explain the benefits, risks, and potential impact of CBDC on everyday financial transactions. Individuals can access educational materials, webinars, or workshops to deepen their understanding and make informed decisions regarding CBDC adoption and usage.

By actively participating, staying informed, and gaining relevant knowledge, individuals can contribute to shaping CBDC policies and preparations. Their engagement ensures that the design and implementation of CBDC reflect the needs and preferences of the public, promoting inclusivity and user-centricity in the digital financial landscape.

Stay Informed:

Participate in Public Consultations:

- Stay informed about public consultations organized by the Bank of Canada and governmental agencies, such as the Department of Finance Canada.

- Engage in surveys, online forums, or town hall meetings to actively share your opinions, concerns, and suggestions on CBDC-related matters.

Explore educational initiatives led by the Bank of Canada and industry organizations:

- Stay informed about the benefits, risks, and potential impact of CBDC through publications, reports, and research from reputable sources like:

- Explore educational initiatives led by the Bank of Canada and industry organizations